Blog

Read my writing about Business, Insolvency, Turnaround, and the Economy.

June 2022 Personal Insolvency Stats

AFSA has released personal insolvency stats for June 2022.

Last month there were 852 personal insolvency appointments, an increased on the 751 in May. This is slightly lower than the 888 we have in June 2021 and less than half of the long run average.

AFSA has released personal insolvency stats for June 2022.

Last month there were 852 personal insolvency appointments, an increased on the 751 in May. This is slightly lower than the 888 we have in June 2021 and less than half of the long run average.

In June there were:

⚡️ 503 Bankruptcies

⚡️ 338 Debt Agreements

⚡️ 11 Personal Insolvency Agreements

For all of FY2021-22 there were 9,550 personal insolvencies, significantly less than the 10,628 in FY2020-21 and less than half of the 21,079 we saw in FY2019-20.

Personal insolvency appointments still have a long way to go to get back to pre-pandemic levels. However, I expect to see them pick up substantially over the next 18 months as the impact of higher interest rates, slow wage growth, high inflation and a probable recession all combine to put more individuals into financial difficulty.

Court Vests Disclaimed Property in Trustee

It’s not often you get to be involved in setting a new legal precedent. Personally, in my almost 20 years working in the insolvency and turnaround industry, I’ve only had a few occasions where we have been successful in creating some new law. Happily, I can add another case to the record.

In a recent decision, the Federal Court made Orders vesting the Bankrupt’s interest in a real property in the Trustee in Bankruptcy, despite a disclaimer of the property being made by the Former Trustee of the bankrupt estate.

It’s not often you get to be involved in setting a new legal precedent. Personally, in my almost 20 years working in the insolvency and turnaround industry, I’ve only had a few occasions where we have been successful in creating some new law. Happily, I can add another case to the record.

In a recent decision, the Federal Court made Orders vesting the Bankrupt’s interest in a real property in the Trustee in Bankruptcy, despite a disclaimer of the property being made by the Former Trustee of the bankrupt estate.

The facts in this case were rather unique. The former Trustee was appointed way back in 2009. At the time, the bankrupt owned real property with his non-bankrupt spouse. The Property was subject to a mortgage by the NAB and, after payment of the mortgage and costs, it was expected that there would be no equity available in the Property. The NAB had also obtained orders for possession and sale of the Property, advised they would be taking their own recovery action. Accordingly, the Trustee, seeing little chance of a return from the Property, disclaimed his interest.

Fast-forward 13 years and Aaron Lucan of Worrells had taken over as Trustee of the Bankrupt Estate, the Bankrupt had still not been discharged because he hasn’t lodged his Statement of Affairs, and the NAB had also not acted on their orders for possession and sale. Then, in September 2021, the NAB elected to discharge their mortgage, leaving the Property unencumbered.

The property now had significant equity available, so the New Trustee applied to the Court, pursuant to Section 133(9) of the Bankruptcy Act, (“Act”) to have the bankrupt’s former interest in the Property vested in him.

Section 133(9) provides the Court with a discretion to make various orders concerning the vesting or delivery of disclaimed property. There are several conditions which must be satisfied before the discretion is enlivened:

(1) there must be disclaimed property;

(2) there must be an application by a person either: (a) claiming an interest in the disclaimed property; or (b) under a liability not discharged under the Bankruptcy Act in respect of the disclaimed property; and

(3) the Court must have heard such persons as it thinks fit.

Conditions 1 and 3 were satisfied without debate, however, at issue was whether the New Trustee had a ‘claim’ in the Property given the Former Trustee had declaimed his interest.

While His Honour (“HH”) found that the making of a claim, not the vindication of that claim, was sufficient to satisfy this precondition, HH also found that the New Trustee did have an interest in the Property.

HH interpreted s133(9) as applying not only where an applicant is a person entitled to the property, but also where an applicant is a person in whom it seems to be just and equitable that the property should be vested. HH also made reference to the duty placed upon a Trustee, pursuant to Section 19(1)(f) of the Act, to take steps to recover property for the benefit of the Estate.

While HH, and the parties, were unable to identify any previous cases dealing with this particular issue, HH made reference to the decision of

Gleeson J In the matter of Vision Forklifts Pty Ltd (in liq) [2020] NSWSC 243 which dealt with the equivalent section of the Corporations Act 2001, section 586F(1).

After establishing the three precondition, HH made orders that it would be just and equitable for the Property to be vested in the New Trustee.

While the circumstance in this case are quite unique, this decision does open up a potential additional recovery option for trustees when property is disclaimed and a change in circumstances results in the property now having significant equity available.

Case Reference: Lucan (Trustee) v State of New South Wales, in the matter of the Bankrupt Estate of Williams [2022] FCA 751 (29 June 2022)

Predictions for insolvency appointments for FY2023

The last quarter has been a wild one for the Australian economy, with mounting headwinds from a range of international and domestic factors. While these factors have placed increasing pressure on businesses, they haven’t yet caused a significant increase in the number of insolvency appointments we are seeing.

The last quarter has been a wild one for the Australian economy, with mounting headwinds from a range of international and domestic factors. While these factors have placed increasing pressure on businesses, they haven’t yet caused a significant increase in the number of insolvency appointments we are seeing.

Corporate Insolvency

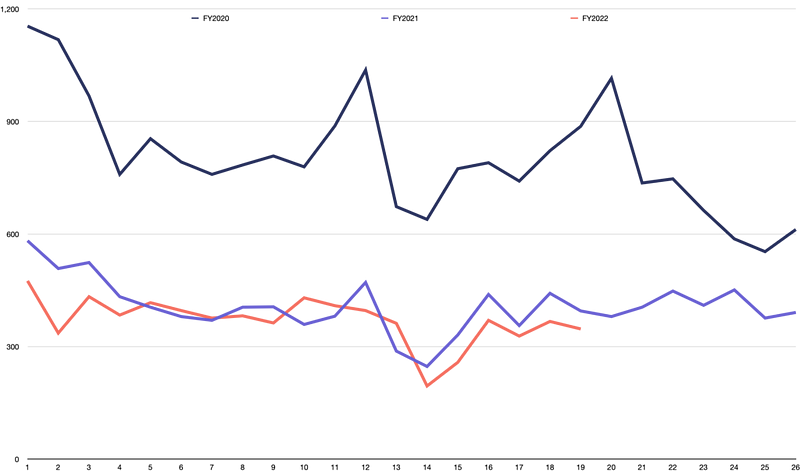

Corporate insolvency appointments in FY 2022 has tracked along at essentially the same rate as FY2021. In FY 2021, we saw total corporate insolvency appointments of 6,049, and while all the numbers aren’t in for FY2022 yet, I expect the final number will be around 6,500 appointments for the year. While that’s an increase of about 7% on last financial year, it is still a long way below the long run average of 10,744 appointments per financial year.[i]

Personal Insolvency

Personal insolvency appointments for FY2022 remained historically low. Running at about 40% of historical norms and continuing to fall in FY2022. For FY2021 there were 10,628 personal insolvency appointments, while we are likely to see in the order of 9,500 in FY2022 by the time all the numbers come in. This is a pretty surprising outcome. Despite the lifting of restrictions on enforcing debts and taking bankruptcy action, we have still seen personal insolvency numbers fall in FY2022. [ii]

The Economy

Despite the low insolvency appointment numbers in FY2022, the business and financial environment continues to deteriorate, with a number of factors likely to create big negative headwinds for the economy in FY2023.

These include:

- Inflation, which was at 5.1% last quarters and is expected to be over 7% by the end of 2022. The RBA has forecast that it will be several years before inflation falls back within their 2 to 3% target range. Continued high inflation will place constant pressure on business and household bottom lines.

- Interest rates are set to increase significantly as the RBA is committed to fighting inflation. We had already seen two increases in recent months and markets are predicting the cash rate to reach 3% by then end of 2022 and peak at 3.8% in mid-2023. For each 1% increase in the cash rate, Australian households see about a 5% decrease in disposable income, meaning less money in the economy to be spent in local businesses.

- Supply chain challenges will continue for the next 18 to 24 months. The cost of shipping goods from our major import markets to Australia remains almost 400% above the historical averages and shortages in transport capacity will keep prices elevated through all of FY2023. China, Australia’s largest trading partner, has given strong indications that lockdowns to support COVID-Zero will remain a core policy for at least the remainder of 2022. As a result, we will continue to see business experience difficult obtaining needed supplies from overseas.

- Staff shortages and increases in wages are already having a significant impact on a lot of industries and this trend will continue through FY2023. Unemployment remains at a near record low of 3.9%, while workforce participation is already at near record highs. One of the key drivers of staff shortages is the freeze on immigration that took place over the pandemic period. While that freeze has been lifted, immigrant workers have been slow to return to Australia and forecasts are that it will be some significant time until immigrations starts to have an impact on staff shortages.

- Energy prices remain very high, especially petrol prices as a result of both the Ukraine war and a global shortage in refining capacity. With global demand expected to remain high and the process to bring on additional capacity a long one, petrol prices will remain high in Australia for the foreseeable future. Australia also has a looming increase in the fuel excise in September this year which will put further upward pressure on petrol prices.

Insolvency Tsunami?

With all these challenges facing the Australian economy it’s only a matter of time until we start to see the impact on businesses and individuals convert into increasing insolvency appointment numbers. However, I don’t think we will see a tsunami. The most likely outcome is a slow increase in appointment numbers through FY2023, with appointment numbers peaking at around 120% of the historical averages in late 2023.

[i] Source: ASIC — Series 1B Notification of companies entering external administration and controller appointments — weekly.

[ii] Source: AFSA’s Monthly personal insolvency statistics 2020; 2021; 2022.

Universal Distributing is no Silver Bullet

A recent case in the NSW Supreme Court gave a good remainder about the limitations of the Universal Distributing principle.

However, the Universal Distributing principle isn’t all encompassing and this case gives an example of when reliance upon it didn’t work out in the external administrator’s favour.

A recent case in the NSW Supreme Court gave a good remainder about the limitations of the Universal Distributing principle.

As a refresher, in Re Universal Distributing Co Ltd (in Liq) (1933) 48 CLR 171, the Court established the principle that an external administrator is entitled to recover costs and expenses related to the preservation and realisation of assets in priority to the interest of a secured creditor in those same assets, and that the external administrator has an equitable lien in respect of such costs and expenses over the assets.

This is obviously a principle that is very useful for external administrators and one that I have used on many occasions to ensure that we got paid for the work we did preserving and realising assets.

However, the Universal Distributing principle isn’t all encompassing and this case gives an example of when reliance upon it didn’t work out in the external administrator’s favour.

In this case, Administrators were appointed to two related entities, Atlas CTL and Pty Ltd (”Atlas”) and PJM Fleet Management Pty Limited (“PJM”). Atlas offered short-term car and truck rentals and leasing of vehicles to ride-share operators, while PJM leased vehicles from a variety of vehicle finance providers (such as Volkswagen, BMW, Nissan, and Toyota Finance) and provided these vehicles to Atlas for leasing. Each of the Finance Companies held purchase money security interests over the vehicles they financed, and Volkswagen and Nissan Finance held each also held a general security agreement with Atlas. It’s fair to say, everything of value was subject to at least one perfected security interest.

The Administrators decided to trade on the business of Atlas, with a view to selling the business as a going concern. However, following a sale campaign, no buyer was found, and the Administrators had accrued a significant trading loss.

At this point, the finance companies appointed receivers and mangers and tools steps to realise their secured property. After the sales were completed and the business of Atlas was shut down, the only significant pool of fund was approximately $5 million held by Volkswagen from the realisation of their secured property.

The Administrators then brought a claim that their remuneration and costs, totalling approximately $2.4 million, were secured by an equitable lien arising from the Universal Distribution principle. The application was made on the basis that the Administrators’ work to preserve and realise the assets of Atlas and PJM had been of benefit to Volkswagen Finance.

The Administrators submitted that an equitable lien would arise when:

* The external administrator acts reasonably.

* The administrator attempts to preserve, secure or realise assets.

* There is a sufficient nexus between the work done and the salvage objective.

* There is a fund (or assets) which may properly be the subject of the lien.

* That it would be unconscientious for the creditors who stand to take the benefit of the fund (or assets) to do so without recognising the administrator’s work.

The Administrator argued that it was reasonable for them to trade on the business with a view to a sale and that where the secured creditors adopted a ‘wait and see’ approach, it would be contrary to public policy to discourage Administrators from trading on businesses.

The Court dismissed the Administrator’s claim, finding that the claim failed both on the principle and on the facts.

The Universal Distributing principle only created an equitable lien over assets, or a pool of funds, if there was a sufficient nexus between the administrator’s activities and the preservation of assets or creation of the fund. In this case, the Court found that the Administrators did not have a role in preserving the assets or in the creation of the funds. In fact, rather than being directed to the preservation or realisation of the secured assets, the Administrators put them at risk by continuing to use them in the trading of the business.

This case gives a timely reminder that before deciding to trade on, and Administrator needs to be aware of both the costs associated with trading and how these will be funded. Further, when it is intended to rely upon the Universal Distributing principle, detailed records need to be retained as to both what work was done, and how that work was related to the preservation and realisation of specific secured property.

The Court Makes Interesting Use of s90–15 of the IPS

The Federal Court has made innovative use of its powers under Section 90–15 of the Insolvency Practice Schedule (“IPS”) to amend various provisions around calling for and adjudicating on Proofs of Debt in Woodhouse (Liquidator), in the matter of Forex Capital Trading Pty Ltd (in liq) [2022] FCA 600.

The innovative approach was in response to a fairly unique set of circumstances. The Company in Liquidation was a seller of over-the-counter derivatives and the Liquidation was faced by approximate 8,600 clients with potential claims against the Company totalling approximately $69.5 million.

The Federal Court has made innovative use of its powers under Section 90–15 of the Insolvency Practice Schedule (“IPS”) to amend various provisions around calling for and adjudicating on Proofs of Debt in Woodhouse (Liquidator), in the matter of Forex Capital Trading Pty Ltd (in liq) [2022] FCA 600.

The innovative approach was in response to a fairly unique set of circumstances. The Company in Liquidation was a seller of over-the-counter derivatives and the Liquidation was faced by approximate 8,600 clients with potential claims against the Company totalling approximately $69.5 million.

The Company had been provided with a letter of comfort by its Ultimate Holding Company (“UHC”) whereby the UHC undertook that, upon request, it would provide financial support to meet any debts incurred by the Company. However, the undertaking was to be terminated on 30 June 2022. Accordingly, there was pressure on the Liquidators to urgently quantify the debts of the Company so that they could make a claim against the UHC before the undertaking expired.

The Liquidators approached the Court and sought Orders that would permit them to conduct an abridged process for the adjudication and admission of claims, that would allow “customers the option to accept a 15% discount on the value of their claims as calculated by the Liquidators by a certain deadline, in exchange for exempting them from providing further detailed evidence as to each element of their alleged claims.”

The expedited process would allow the Liquidators to quantify the Company’s debts and make a claim under the undertaking before it expired, maximising the potential return to creditors.

Given the obvious commercial logic behind the application, the Court sensibly made Orders, amending the process for calling for and adjudicating on proofs of debt set out in Corporations Regulations 5.6.48, 5.6.49, and 5.6.54. In particular, the Orders set out the form of the notices to be sent to creditors to satisfy the Liquidators’ obligations and the notices are well worth a read.

It’s great to see the Court sensibly utilise its powers under s90–15 of the IPS to assist Liquidators to maximise the likely outcome for creditors. It’s for situations like this one that these powers exist.

Link to the Judgement: https://www.judgments.fedcourt.gov.au/judgments/Judgments/fca/single/2022/2022fca0600

A First Decision on Creditor-Defeating Dispositions

The creditor-defeating dispositions provisions have had what is, to my knowledge, their first outing, with the Victorian Supreme Court handing down a decision in Re Intellicomms Pty Ltd (in liq) [2022] VSC 228 (11 May 2022), voiding a sale of the company’s business to a related entity.

The creditor-defeating dispositions provisions were introduced, as a new class of voidable transactions, in 2020 as part of a package of legislation to combat illegal phoenix activity.

The creditor-defeating dispositions provisions have had what is, to my knowledge, their first outing, with the Victorian Supreme Court handing down a decision in Re Intellicomms Pty Ltd (in liq) [2022] VSC 228 (11 May 2022), voiding a sale of the company’s business to a related entity.

The creditor-defeating dispositions provisions were introduced, as a new class of voidable transactions, in 2020 as part of a package of legislation to combat illegal phoenix activity. The provision is found in section 588FBD of the Corporations Act, and the key part for this case is found in subsection 1:

(1) A disposition of property of a company is a creditor-defeating disposition if:

(a) the consideration payable to the company for the disposition was less than the lesser of the following at the time the relevant agreement (as defined in section 9) for the disposition was made or, if there was no such agreement, at the time of the disposition:

(i) the market value of the property;

(ii) the best price that was reasonably obtainable for the property, having regard to the circumstances existing at that time; and

(b) the disposition has the effect of:

(i) preventing the property from becoming available for the benefit of the company’s creditors in the winding-up of the company; or

(ii) hindering, or significantly delaying, the process of making the property available for the benefit of the company’s creditors in the winding-up of the company.

On the face of it, the fact in this case are pretty suspicious. Intellicomms operated a business providing translation services to businesses in Australia and New Zealand. On 8 September 2021, the company transferred its business to a related entity that had been incorporated just two weeks before the transaction. Intellicomms was put into voluntary liquidation on the same day the transaction was completed.

The Liquidators sought to have the Sale Agreement set aside as a creditor-defeating disposition within the meaning of s 588FDB of the Act, and a voidable transaction within the meaning of s 588FE(6B) of the Act.

While the business had been sold following a valuation, its Director had obtained several valuations in the months before the sale, providing the valuers with increasingly pessimistic inputs as to future trading revenue. This caused the valuations to decrease from over $11 million in the first one obtained, to only $57,000 for the one relied upon to sell the business.

The Judge, not surprisingly, found the transaction to be a creditor defeating disposition, opining:

“I consider that the Sale Agreement has all the features of what has become known as a phoenix transaction; indeed, it is a brazen and audacious example. The effect of the Sale Agreement was to strip Intellicomms of what assets it had to satisfy the claims of its creditors and transfer them to an entity which was closely associated with its director”

With such a straightforward set of facts, we don’t get much in the way of interesting clarification of how the provisions will work in practice, however, there was one interesting point made. His Honour expressed the view that Liquidators are only required to establish that, on the balance of probabilities, the consideration payable under the Sale Agreement was less than the market value or the best price that was reasonably obtainable and that there was no onus on the Liquidators to evidence actual values.

It’s great to see these new provisions get a successful outing. They provide another useful tool in the Liquidators toolbox to combat phoenix activity.

An Update on Debt Collection Activity

After a long hiatus over the pandemic period debt collection activities across the economy are slowly starting to return to normal levels. While the number of corporate insolvencies, bankruptcies and wind-up notices remain well below historical levels, they are slowing increasing. Here’s a quick update about what I am seeing and hearing around the industry.

After a long hiatus over the pandemic period debt collection activities across the economy are slowly starting to return to normal levels. While the number of corporate insolvencies, bankruptcies and wind-up notices remain well below historical levels, they are slowing increasing. Here’s a quick update about what I am seeing and hearing around the industry.

The ATO

The ATO broke their silence on their debt collection activities last Friday, confirming that they are ramping up debt collection activity while still focusing on providing support and assistance to those with overdue debts. The ATO advised that they would be continuing to use a collaborative approach with most taxpayers and, for the moment, firmer action would only be taken where taxpayers aren’t receptive to communication.

The ATO confirmed that they have issued 29,552 awareness letters for disclosure of business tax debts and 52,319 awareness letters about the use of Director Penalty Notices (“DPNs”). Word on the street is that the ATO has identified around 150,000 small businesses that require compliance attention and that they intend to issue a further 50,000 DPN warning letters through the end of the financial year.

While this is a definite step up from where the ATO was during the pandemic, this still represents a very soft approach to debt collection and is a long way from the ATO’s stated goal of ensuring that there is no unfair advantage to non-payers.

In my experience that ATO has remained very open to doing deals to compromise tax debts that accrued through the pandemic, especially through formal processes like Small Business Restructuring or Voluntary Administration. However, I am also hearing that their patience is running out, and in particular, several clients have been told that the current payment plan will be the last that the ATO is willing to offer them.

I expect the ATO will slowly ramp up activity over the next 18 months, progressively increasing their compliance activities as time goes by. That being said, now is the time to do deals, before the ATO moves from the current support setting and starts focusing more on collecting outstanding tax debt.

Landlords

I’m seeing landlords start to take action to recover rent that was deferred during the pandemic period. I suspect this is going to be a bit of a balancing act for landlords for a while, as the desire to collect deferred rent conflicts with a desire to hang onto existing tenants in a relatively weak rental market. This will especially impact landlords holding retail, hospitality and commercial office space.

Like with the ATO, I am seeing a general willingness from Landlords to do deals to compromise deferred rent. In particular, now is a great time for businesses to proactively reach out to their landlords and seek to negotiate a settlement on any deferred rent. I’ve seen some great results from this approach.

Institutional Creditors

There are also starting to be signs of debt collection action from institutional creditors. Some companies are starting to take steps to return to a more normal debt collection setting, including instructing agents and selling debt books for collection. I’m also hearing that some of the major institutional creditors are starting to talk about lifting the bans they placed on ‘firmer action’ during the pandemic period.

Banks and Mortgages

Except in extreme circumstances, I’m not seeing a lot of movement from the major banks either on business debt or mortgages with arrears. I expect the major banks will be the most conservative of the creditors and the slowest to restart their normal debt collection processes. Particularly with mortgage debt, the banks have built up significant LVR buffers with most clients and overall mortgage stress remains low, meaning something significant will have to change for the banks to risk the political fallout from a round of foreclosures.

Unfair Preferences and the High Court

It was a strangely busy day for the High Court today when it comes to considering cases related to unfair preferences, with movement on both the ‘Peak Indebtedness’ rule and 553C Set-off.

It was a strangely busy day for the High Court today when it comes to considering cases related to unfair preferences, with movement on both the ‘Peak Indebtedness’ rule and 553C Set-off.

Peak Indebtedness

Submissions were published in the matter of Bryant & Ors v. Badenoch Integrated Logging Pty Ltd

As many of you will recall, on 10 May last year, the Full Court of the Federal Court of Australia (“FCFCA”) handed down a decision that the ‘peak indebtedness rule’ which has been a long-standing precedent in preference claims, was abolished with the introduction of section 588FA of the Corporations Act (“Act”). You can read about that decision at https://www.linkedin.com/pulse/peak-indebtedness-rule-preference-claims-abolished-brendan-giles/

The decision has been appealed to the High Court and we finally get a look at the submissions by the appellant.

The submissions are focused on two grounds:

(a) In enacting section 588FA of the Act, did Parliament intend to abrogate a liquidator’s right to choose any point during the statutory relation back period, including the point of peak indebtedness, in an endeavour to show that from that point there was an unfair preference (the peak indebtedness rule)?

(b) Will a continuing business relationship, within the meaning of section 588FA(3) of the Act, cease if the operative and mutual purpose of inducing further supply of goods or services is subordinated to a predominant purpose of recovering past indebtedness?

Clarity on both these points will go a long way to clearing up the lingering uncertainty in this space following the FCFCA decision.

As I’ve said previously, I found the decision by the FCFCA is a more equitable approach. I have never seen an equitable justification for allowing the Liquidator to choose a date that maximised the preference claim and nothing in the submissions in compelling enough to make me change my mind.

553C Set-off

The High Court also granted an application for special leave to appeal in the decision of the FCFCA in the matter of MJ Woodman Electrical Contractors Pty Ltd v Metal Manufactures Pty Ltd [2021] FCAFC 228.

In that case the FCFCA clarified the, until then, quite confused law around the availability of set-off as a defence to an unfair preference claim, confirming that set-off was not available as a complete or partial defence for a creditor facing an unfair preference claim.

While we won’t see submission on this one for a while, it will be interesting to see the basis upon which the appeal in being made. I personally think that the FCFCA got this one right as well and expect that the High Court will be more likely to remove any doubt around the issue, rather than to overturn the FCFCA’s decision.

2022’S MAJOR BUSINESS CHALLENGES THAT WILL DRIVE AN INCREASE IN BUSINESS FAILURES

WE’RE IN FOR A WILD RIDE! AND MORE INSOLVENCIES WILL BE PART OF THE PRICE.

We all know the story by now, insolvencies have been down on the long-term average for two years now and so far, at least, we aren’t seeing much of an uptick. While the mood around the industry is that the tide is starting to turn, this isn’t being borne out in the hard numbers yet.

WE’RE IN FOR A WILD RIDE! AND MORE INSOLVENCIES WILL BE PART OF THE PRICE.

We all know the story by now, insolvencies have been down on the long-term average for two years now and so far, at least, we aren’t seeing much of an uptick. While the mood around the industry is that the tide is starting to turn, this isn’t being borne out in the hard numbers yet.

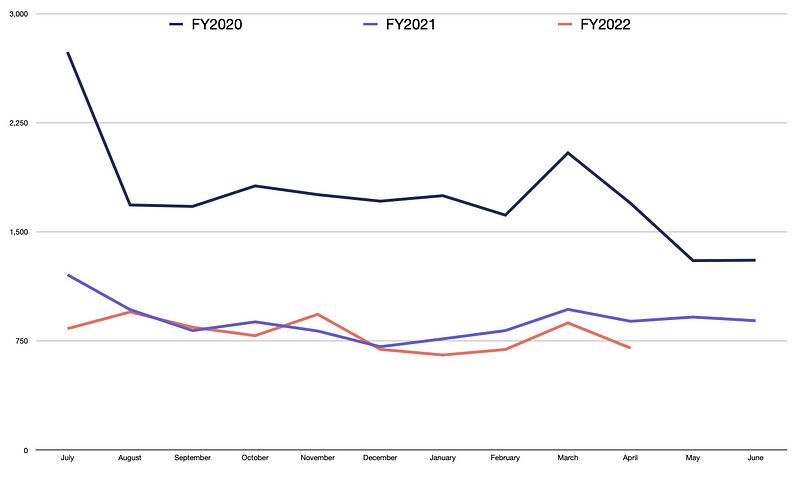

Corporate insolvency appointments for the year to date remain down approximately 35% on historical levels, exactly the same decrease we saw at the same time in 2021.

Source: ASIC — Series 1B Notification of companies entering external administration and controller appointments — weekly.

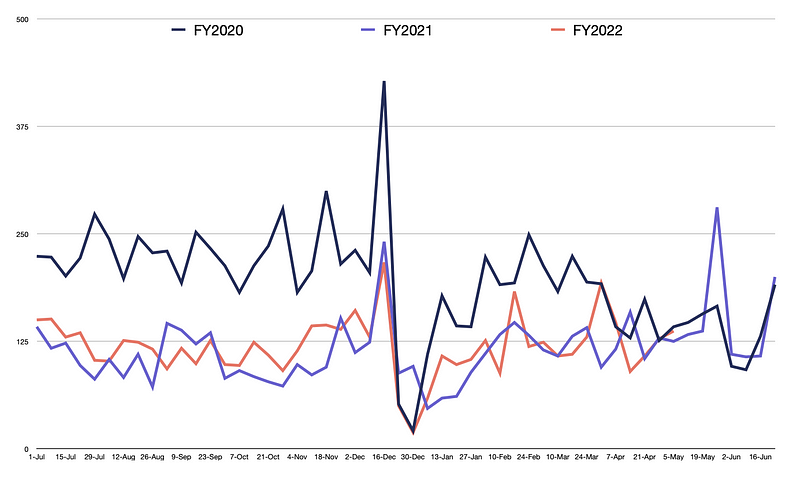

In the personal insolvency space, the story is the same, with the number of appointments slightly lower than 2021 and still less than 50% of the long-term average.

Source: AFSA’s Provisional annual personal insolvency statistics 2020; 2021; 2022.

Despite actual appointments still being sluggish, the consensus across the industry is that enquiry levels have increased substantially in 2022 and the insolvency market looks to be moving back towards normal appointment volumes.

Let’s take a quick look at the major challenges businesses are likely to face over the rest of 2022 that will drive an increase in business failures.

The debt collection holiday is over

The Australian Taxation Office (ATO) historically was Australia’s most active creditor. The ATO filing winding-up applications against companies and issuing director penalty notices (DPNs) and statutory demands were a significant catalyst for both voluntary liquidations and companies restructuring.

When COVID-19 hit in early 2020, the ATO halted its debt recovery action. The ATO has now restarted its debt collection activities, addressing the backlog of tax debt accrued over the last two years but expects that it will take a couple of years to catch up. Therefore we expect to see ATO action resulting in more insolvency appointments than we’ve traditionally seen.

Other creditors who deferred debts in support of SMEs through the pandemic period are reverting to normal debt collection practices. In particular, we are starting to see landlords take steps to recover the rent deferred during the pandemic.

Uncertainty in supply chains

One of the other big factors causing businesses difficulty is the continuing uncertainty in supply chains. This has made it difficult for businesses to get the supplies needed to run their business and is more expensive when supplies can be obtained.

The rising costs of building materials was a key factor in the recent high-profile failure of both ProBuild and Condev. These supply chain issues will continue for some time, with the war in Ukraine and associated sanctions, China’s ongoing commitment to COVID-Zero, and structural issues in the global supply chain are expected to continue influencing supply chains beyond 2022.

Inflation and interest rates

Hand in hand with supply chain issues is inflation increasing, forecasted at 4.9% over the next two years. This will put pressure on business through rising costs and wage increases that will flow from that.

Also expected is the Reserve Bank of Australia raising interest rates this year, with rates likely to rapidly return to more ‘normal’ levels around 2% in the next 12 to 18 months. This will add pressure by increasing business’s debt servicing costs, while also reducing disposable income that consumers have to spend.

Australians have very high levels of household debt, meaning the impact of interest rate rises on disposable income is significant. A 2% increase in interest rates would result in a 10% reduction in household disposable income meaning they have less money to spend in local businesses.

What this means for insolvency appointments

In short, both corporate and personal insolvency appointments will increase. We expect to see insolvencies pick up after the May election and to peak at well above historical levels in early- to mid-2022 as the combined impact of more difficult business conditions, less accommodating creditors, and the hangover from pandemic trading conditions combine to produce a uniquely and profoundly difficult environment for SMEs.

The ATO has Changed the Rules on DPNs

It looks like the ATO has changed the steps that a Director can take to avoid personal liability when they receive a Non-Lockdown Director Penalty Notice (DPN). Specifically, they have removed the option to enter into a payment arrangement and added appointing a small business restructuring practitioner.

It looks like the ATO has changed the steps that a Director can take to avoid personal liability when they receive a Non-Lockdown Director Penalty Notice (DPN). Specifically, they have removed the option to enter into a payment arrangement and added appointing a small business restructuring practitioner.

As a refresher, the ATO can issue a DPN to make a director personally liable for a penalty equal to the value of a Company’s overdue SGC, PAYG and GST.

There are two types of DPN’s:

- A Non-Lockdown DPN, which can be issued when a company has lodged its Business Activity Statements (BAS) and Instalment Activity Statements (IAS) within three months of the due date and Superannuation Guarantee Charge (SGC) statements within one month and 28 days after the end of the quarter and has not paid the debt.

- A Lockdown DPN, which can be issued where a company has not lodged their BAS, IAS, or SGC statements within the above timeframes and has not paid the debt.

The only option available to a Director who receives a Lockdown DPN is to pay the penalty, or seek relief under one of the statutory defences.

For a Non-Lockdown DPN, pre-COVID the ATO offered Directors the following options to avoid personal liability:

- the company’s tax liability is discharged;

- the company went into administration;

- the company went into liquidation; or

- the company entered into a payment arrangement

However, the ATO appears to have changed the options with recently issued DPNs. Going Directors the following options to avoid personal liability:

- the company complies with its obligation to pay the unpaid amount to the ATO;

- the company goes into administration;

- the company appoints a small business restructuring practitioner (SBRP);

- the company goes into liquidation.

This change appears to be a result of the decision in Clifton (Liquidator) v Kerry J Investment Pty Ltd trading as Clenergy [2020] FCAFC 5, that entering into a payment arrangement does not cause a tax debt which is due and payable to cease to be due and payable.

This change is a good one and will see more taxation debts dealt with at the time a DPN is issued. Too often entering into a payment arrangement is simply kicking the can down the road as it does not deal with the Company’s tax debt, just delays enforcement for period until the Company falls behind again and a new DPN is issued.

By pushing Directors to make a final decision, to either formally restructure their debts though SBR or Administration, or appoint a Liquidator, we will hopefully see less zombie corporations continuing to trade.