Blog

Read my writing about Business, Insolvency, Turnaround, and the Economy.

Correcting Misinformation about Small Business Restructuring

Disappointing to see another article in the mainstream media spreading fear and misinformation about the Small Business Restructuring Process (SBR).

The main claim in the article, that the process is overly complicated, is just not true. While the legislation that governs the process has been drafted in a way that makes it difficult to follow, SBRs are an easy and straight forward process in practice.

While take up has been low, any supposed complexity is not the main driver of low appointment numbers. From my experience in the market place, three main drivers are making it difficult for small businesses to take advantage of the SBR process:

1: There is a general lack of awareness that they exist as an option. The government and ASIC have done a very poor job of teaching small business owners and their advisors that SBRs are an option to deal with debt.

2: In order to propose a Restructuring Plan, a company must have paid all employee entitlements. In 3 out of 5 of the companies that approach me about restructuring, this is the key impediment to restructuring. These businesses often have superannuation debts that accrued over the COVID period as a result of Job Keeper payments that they have no way of paying. This immediately prohibits them for entering the SBR process. A simple reform to allow employee debts to also be restructured (similar to what is allowed in the VA process) would solve this issue.

3: There is a cap on debts that can be restructured through an SBR of $1 million. Many businesses exceed this cap and accordingly cannot access the process. Unfortunately for these businesses, Voluntary Administration, the only alternative, costs at a minimum 3 to 4 times as much as an SBR costs, leaving these businesses with no viable option. The ASBFEO's proposal to increase the debt cap to $5 million would be a good start to resolve this issue.

The SBR process is a great innovation for Australian small businesses, providing them with a quick, cheap and effective restructuring option. I've seen how well in can work in the real world across a wide range of industries. However, the restrictions that the government put in place when they introduced the process are limiting the opportunity for small businesses to use the process.

Given the challenges facing the business community heading into 2023, loosening the restrictions would be the right way to improve SBRs and allow more business to take advantage of them, rather than a technocratic focus on simplifying legislation that already works just fine in practice.

https://www.smartcompany.com.au/business-advice/small-business-simplified-restructuring-scheme/

Consumer Confidence and Inflation Expectation Improve

Some excellent news in the first ANZ-Roy Morgan survey of the year.

💸 Consumer Confidence surged, up 4.9 points to 87.4. The highest since September last year.

💸 Inflation expectation also had a big drop, down 0.9% to sit at 5.0%.

💸 All the confidence sub-indexes improved, indicating a broadly positive view about the economy as we head into 2023.

These are all very good signs to start the year.

While confidence remains low, it looks to be heading in the right direction, which will support spending and help avoid a recession later this year.

While the fall in inflation expectations, if it continues, will place less upward pressure on wages and give the RBA more leeway to slow interest rate increases.

My Best Books of 2022

With 2022 coming to an end its a good time to look back at the seven best books I read in 2022. I love reading, it's one of my favourite hobbies and a great way to unwind at the end of a work day or on a weekend, while still learning something new, expanding your understanding, or challenging your existing ideas.

The War That Made the Roman Empire: Antony, Cleopatra, and Octavian at Actium

https://www.amazon.com.au/dp/1982116676?ref=x_gr_bb_amazon

I'll start with this one because it was my favourite read of the year. A wonderfully detailed and vibrant retelling of the events that led to the Battle of Actium, a pivotal moment in the formation of the Roman Empire. The battle at Actium and the manoeuvring and battles that lead to it are some of the most important events in western history, as they directly lead to the formation of the Roman Empire under Augustus. However, they are not well now and it's great to have a book dedicated t the topic.

Talent: How to Identify Energizers, Creatives, and Winners Around the World

https://www.amazon.com.au/dp/1250275814?ref=x_gr_bb_amazon

An excellent dissection of the art and science of finding talented individuals. Based heavily of research, this books provides a wealth of practical tips and strategies that can be used right away in your own business.

With a worker shortage well documents being able to identify and attract talent is more imporant than ever.

Slouching Towards Utopia: An Economic History of the Twentieth Century

https://www.amazon.com.au/dp/0465019595?ref=x_gr_bb_amazon

Brad DeLong's wonderful economic history of the 'long twentieth century', from 1870 to 2010, that saw human wealth, health and standards of living explode to unimaginable levels. The book breaks down how this unprecedented explosion of wealth occurred, how it transformed the world, and why it failed to deliver us to utopia. It shows the last century to have been less of a march towards utopia and more a slouch in the right direction.

This books covers so much ground its unmissable. It's important to know how we got here, so we know where we are going.

Why We Fight: The Roots of War and the Paths to Peace

https://www.amazon.com.au/dp/1984881574?ref=x_gr_bb_amazon

Another practical book that looks at the root cause of conflict between gangs, parties, or nation states and what causes them to explode into violence. This books took on extra relevance with Russias invasion of Ukraine and provides a great framework for understanding the thought process that led Russia to take what to a rational observer seems like an insane step, invading Ukraine.

Best of all its a hopeful book, providing detailed and practical advice on how to work around or avoid each of the avenues that lead to violent conflict. The strategies to avoid conflict can be applied in your day to day business dealings as well.

The Price of Time: Interest, Capitalism and the Curse of Easy Money

https://www.amazon.com.au/dp/0241569168?ref=x_gr_bb_amazon

Another very timely book that cover the history of low interest rates. Over the centuries whenever interest rates have collapsed and money was too easy, financial markets have become unstable. This book runs through the history of interest rates and takes a detailed looks at the distortions that ultra low interest rates cause and especially, the bubbles that are created and the productivity destruction that occurs from ultra low interest rates.

It's an important book to read an understand as the world economy recovers from the low interest rates cycle of the last two decades so that we don't make the mistake of ultra-low interest rates ever again.

Of Boys and Men: Why the Modern Male Is Struggling, Why It Matters, and What to Do about It

https://www.amazon.com.au/dp/1800750544?ref=x_gr_bb_amazon

This books deals with an important cultural issue that has snuck up on Western society and it not getting enough play in the wider discourse, the deterioration of outcomes for boys and men, especially those in lower socio-economic demographics.

The books relies heavily on research, but it is conveyed in a simple and understandable format that is easy to follow. And, like all good books in this space, this one provides actionable steps that individuals and policy makers can take to being to resolve the issue.

The War on the West

https://www.amazon.com.au/dp/0063162024?ref=x_gr_bb_amazon

Another important book given our times, that discusses the current trend in western countries to demonise our own culture and ignore the shortcomings of others. While I don't really agree with all of the authors positions, and he goes too far at points, it's always good to read books that expand your range and challenge the position you already hold.

Given the many wonders that western democracy has brought the world, and the march these countries have made towards freedom and equality, it's important western institutions are defended. While it's obvious that western nations still have shortcomings and challenges to tackle, we've come a very long way, and that progress should be a focus that is celebrated. This books is an entertaining and incisive takdown of some of the extremes of anti-western sentiment.

Christmas and Boxing Day spending exceeds expectations

After some low numbers in early December, pre-Christmas retail sales have defied expectations to post a record result.

According to Westpac and the ARA:

💰Christmas spending was up 8.6% YoY for a total of $74.5 billion

💰Boxing Day trading was even better with growth of 15.3% YoY with a daily total of $1.23 billion.

It seems that Australian consumers aren't done with their post-COVID spending spree just yet.

I expect that above trend retail spending will persist well into 2023, buoyed by low unemployment and the significant excess savings still sitting on household balance sheets.

Consumer sentiment improving

Some interesting data out today.

Consumer confidence was up for the second week in a row, but remains at very weak levels. A combination of a strong labour market and an easing of policy by the RBA seem to have combined to offset the gloomy economic conditions.

On the same note inflation expectations eased slightly from last week, down to 6.3%. However, they are still far too high and have now remained above 5% for all of 2022. There's a not insignificant risk that inflation expectations are becoming anchored well above the RBA's target range.

Time to buy a major household item also rebounded a strong 9.2%, after a cumulative decline of 13 per cent over the previous six weeks. This could be a indication of rising consumer sentiment, or maybe just an awareness that Black Friday sales are incoming.

While this is a pretty good print, these weekly indicators are quite noisy and we've seen more than a few misleading upward turns in consumer confidence this cycle. We need to put together a couple months with a consistent trend before we can be confident things are improving.

The RBA is loosening prematurely

The RBA doubled down on their dovish pivot in the minutes of their November board meeting released this week, declaring they are prepared to pause rate increases for a period.

“Acknowledging the uncertainty, members did not rule out returning to larger increases if the situation warranted. Conversely, the Board is prepared to keep rates unchanged for a period while it assesses the state of the economy and the inflation outlook. Interest rates are not on a pre-set path.”

This is a significant de-facto loosening of monetary policy that was reflected in the implied future cash rate. Since the end of October market prediction of the peak cash rate have fallen from 4.170% to 3.780% yesterday.

This feels like an overly aggressive move by the RBA. They are jumping the gun and loosening monetary policy prematurely. I would have liked to see the following key indicators turning the corner before the RBA slowed or paused rate increases:

⭐️ Consumer spending falling at least back to trend. It currently remains well above trend and has been above trend for years.

⭐️ Inflation expectations falling back towards the target range. inflation exceptions are currently running at 6.5% and have been consistently above 5% for over a year.

⭐️ Unemployment increasing back to trend levels. The unemployment rate was at an all time low of 3.4% and has fallen consistently all year.

⭐️ Some moderation in the ABS's new monthly inflation indicator. While this is a new indicator, it gives a much more timely picture of inflation and have been rising each month since it's introduction.

As Jerome Powell said recently the majority of risk for central banks is in not tightening enough.

"From a risk management standpoint, remembering of course that if we were to over-tighten, we could then use our tools strongly to support the economy, whereas if we don't get inflation under control because we don't tighten enough, now we're in a situation where inflation will become entrenched and the costs, the employment costs in particular, will be much higher potentially. So, from a risk management standpoint, we want to be sure that we don't make the mistake of either failing to tighten enough, or loosening policy too soon."

Labour Force Update

Hot on the heels of wage price index release yesterday, we have Labour Force data out form the ABS today:

📎 Unemployment is down to 3.4%

📎 Australia created 32,200 new jobs

📎 Underemployment rate stayed at 6.0%

📎 Full time jobs were up 16,800.

This is a great jobs report and shows continued strength in the Australian jobs market (and this time we have no sample group distortions throwing out the figures).

On the back of the encouraging print for the Wage Price Index yesterday, this is really good news for workers. The continued labour market tightness should lead to further wage increases.

From an RBA perspective, this print is right on line with the RBA's forecasts and shouldn't have any impact on the RBA's interest rate decision.

September quarter wages grow more than expected

The wage prices index is out for the September quarter, with wage growth coming higher than expected:

👷🏻♀️ Wages rose 3.1% YoY and 1.0% QoQ.

👷🏻♀️ Private sector wages rose 3.4% YoY and 1.2% QoQ.

👷🏻♀️ Public sector wages rose 2.4% YoY and 0.6% QoQ.

👷🏻♀️ Wage growth including bonuses was up 3.8% YoY and 1.4% QoQ.

Four things we can learn from this print.

First, wage growth is finally starting to pick up after a long period in the doldrums. Given the tight labour market Australia has been experiencing, this is not a surprise.

Second, public sector wage deals are really stating to hold back wage growth, with public sector growth now well behind private sector growth. This is something governments can directly address.

Third, real wage growth is still sharply negative, running -3.8% YoY and -0.8% QoQ, meaning wages earners continue to go backwards in real terms.

Fourth, jobs covered by individual arrangements made up the majority of wage growth. Again, this isn't a surprise. Individual deals are often shorter term and are able to react to market changes more quickly, but it does highlight some of the deficiencies in out collective bargaining systems.

While higher wage growth is a good development for the economy, real wage growth is still sharply negative and there is little risk of wage growth significantly contributing to inflation any time soon. While this print is higher than expected, I don't see it having any impact on the RBA's current interest rate trajectory.

US October Inflation Moderates

Some better inflation news out of the USA overnight, with inflation figures for October coming in below expectation.

⭐️ Headline inflation moderated to 7.7% YoY

⭐️ Headline inflation was up only 0.4% MoM

⭐️ Core inflation is at 6.3% YoY

⭐️ Core inflation was up 0.3% MoM

While inflation is still way above where the Federal Reserve wants it to be, and we can't make judgements based on a single monthly print, it's encouraging to see the pace of inflation slowing.

In particular, core goods inflation continues to fall, while core services inflation has risen less than anticipated.

Off the back of this lower than expected print, the market is now anticipating a 50bp increase in interest rates by the Fed at their December meeting, which makes sense to me. With signs the tide may be starting to turn, slowing down a bit and waiting to see how things develop makes some sense.

Insolvency appointments remain low

However, we’re headed for recession and more insolvency appointments.

Another quarter has flown by and it’s time to take another look at how insolvency appointment numbers are tracking and look into our crystal ball to see what the future might hold.

The current picture

First, let’s look at where insolvency appointments are at the moment.

Corporate insolvency

Corporate insolvency appointments are up.

In the first quarter of FY2023 appointments were up 60% on the same period last year and were much closer to historical levels than they have been over the last two years, with appointments averaging 840 per-month over the last three months.

Of particular note is the growing popularity of small business restructuring (SBR). So far this year, we have had 83 SBR appointments, more than we had in the first eighteen months following the introduction of SBRs.

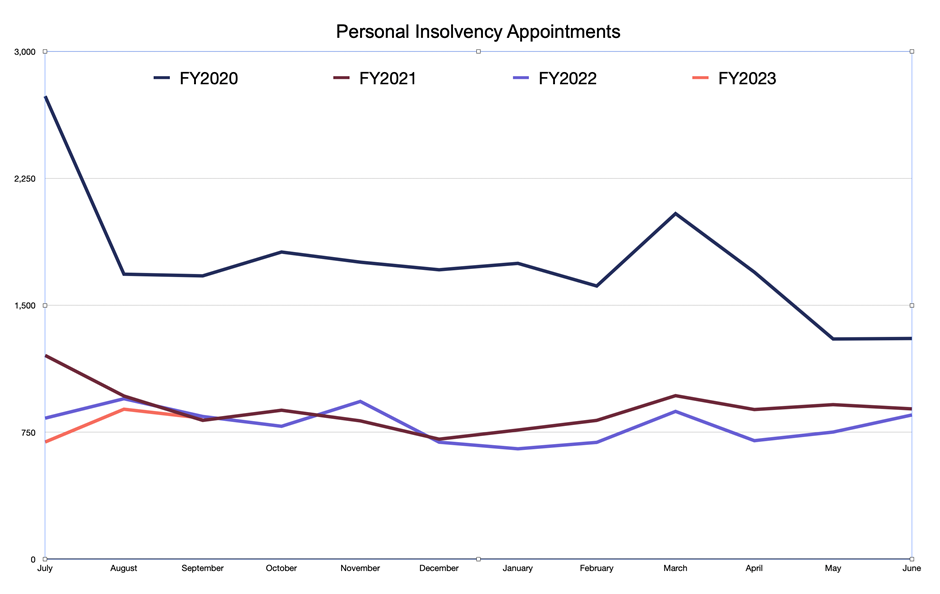

Personal insolvency

Personal insolvency appointments remain low.

In stark contrast to corporate insolvency appointments, personal insolvency appointments this financial year are lower than ever. This continues the depressed appointment numbers we have had over the last two years.

A strong economy

So, what’s going on? Why—Despite all the years of lockdowns, talk of zombie companies and business stress, and muted economic difficulties—has the number of insolvency appointments remained well below historical trends?

The main reason is, despite some headwinds, Australia’s economy is doing well and as long as this continues, insolvency appointments are likely to stay below the trend.

Business conditions remain strong

Business conditions, as measured by the NAB Quarterly Business Survey[iii] remain well above average. While businesses are facing some headwinds, in particular difficulties with staffing, the availability and cost of some supplies, and rising interest rates, trading conditions are good, which is keeping businesses from failing.

Consumer spending

Further to generally good business conditions, household spending remains very strong and well ahead of trend. Consumer spending has been elevated for all of 2022 so far, as low unemployment and strong household balance sheets have allowed people to get out and spend money at record rates.

I expect this trend to continue well into 2023. Australian households still have a huge war chest of excess savings (about $294 billion) , built up over the pandemic period, to deploy before they will be forced to tighten their belts.

Downside risks

Unfortunately, it’s not all good news. While the economy is doing well currently, businesses and households will face significant challenges over the longer run that will lead to an increase in insolvency appointments over the next two years.

ATO debt collection

The Australian Taxation Office (ATO) restarted its debt collection processes, after a long hiatus during the pandemic period. As at December 2021, the ATO's debt book was $61.4B, up 16% from the year before; and the ATO will need to work through and collect this debt over the coming years. The ATO has issued about 7,000 director penalty notices (DPNs) this year and is issuing more at a rate of 300/ business day. The ATO has also recommenced filing wind up applications. The ATO has filed 35 wind up applications so far this financial year, already a significant increase on the 10 filed in all of FY 2020-21, but still a long way short of the 3,571 the ATO filed in FY2015-16.

This pressure will have a dual impact on insolvency appointments. First, direct pressure, as the ATO pushes businesses into an insolvency appointment following its debt collection activities; and secondly, as other creditors who have also withheld from firmer debt collections activities, now feel comfortable resuming firmer action following the ATO’s.

Inflation and interest rates

Inflation continues to be a problem, with the most recent result, for September, showing inflation running at 7.3% per annum and continuing to accelerate. Forecasts are for inflation to remain well above the RBA’s target range of 2.00% to 3.00% for two more years.

As a result, we will see interest rates continue to rise as the RBA takes action to bring inflation back down to the target range. Currently, the RBA’s cash rate is 2.60%. However, markets are implying we will see a peak rate for 4.20% in late 2023. This will place significant pressure on household budgets, which will flow through to business conditions.

Real wages are falling fast

The other downside risk for household spending, and thus the fundamentals underpinning the entire economy, is the rapid fall we are seeing in real wages. A combination of sluggish wage growth and high inflation has seen real wages fall to 2010 levels over the last 18 months.

This fall in real wages (especially if it continues) will eventually flow through to household spending and lead to a significant decline in business conditions, leading to more corporate and personal insolvency.

Recession?

The final factor that will lead to increased insolvency appointment numbers over the next two years is that our economy is very likely to slip into recession near the end of 2023 or in early 2024. The historical precedent is clear, periods of high excess inflation always require a recession to being broad-based inflation under control.

The global economy is slowing and likely going into recession in mid-2023 combined with domestic factors driven by a combination of households exhausting excess savings, declining real wages, and rising unemployment and interest rates will continue to put pressure on household budgets; leading to a decline in consumer spending and conditions for business, which will ultimately push our economy into a short recession.

While a recession will lead to higher insolvency appointment numbers, I do not expect to see levels as high as we saw during previous downturns.

It’s pretty clear that a downturn is coming, and the current positive trading conditions will allow many businesses to take steps to position themselves to better weather the storm, and I also expect the recession to be relatively short and shallow, meaning the impact will be limited.

References

[i] Australian Securities and investments Commission – insolvency Statistics (current) – Series 2 - https://asic.gov.au/regulatory-resources/find-a-document/statistics/insolvency-statistics/insolvency-statistics-current/

[ii] Australian Financial Security Authority - monthly personal insolvencies - https://www.afsa.gov.au/about-us/statistics/monthly-personal-insolvency-statistics

[iii] NAB Quarterly Business Survey - September 2022 - https://business.nab.com.au/nab-quarterly-business-survey-september-2022-56500/

[iv] ANZ Research - https://www.anz.com/institutional/our-expertise/anz-research/

[v] ASX - https://www.asx.com.au/data/trt/ib_expectation_curve_graph.pdf