A few takeaways from yesterday’s interest rate decision by the RBA

- As well as bumping rates, the RBA made a huge revision to their forecasts, with the central forecast now predicting headline inflation of around 6.00% and underlying inflation of around 4.75% by the end of 2022 before a steady decline. Their previous forecast was 2.75% made in February this year. This new forecast is also a long way from the government’s forecasts that underlined the budget last month. It’s somewhat concerning that both treasury and the RBA got it so wrong only a couple of months ago.

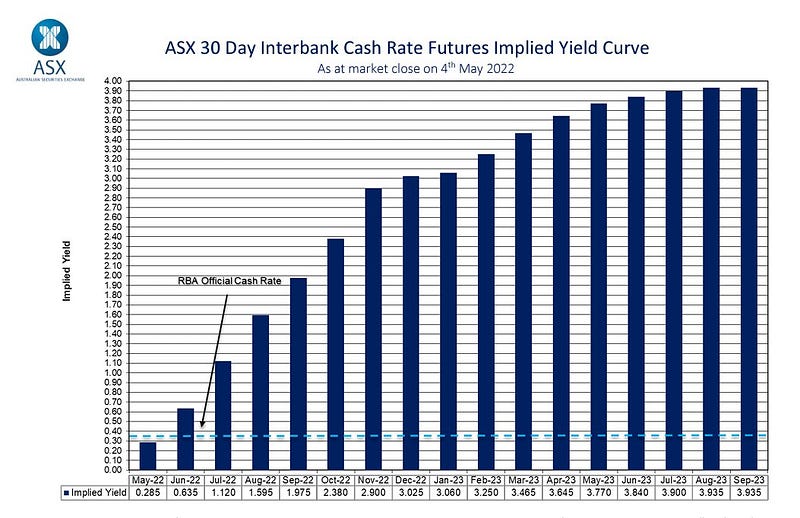

- Lowe made some interesting comments in his press conference after the decision: “It’s not unreasonable to expect that interest rates could rise to 2.5%”. He followed up with “How quickly we get there and if we do get there will be determined by how events unfold. We have an open mind, over the past two years we have been very flexible, it changed in response to changing circumstances and we will continue to do that… a more normal level. How fast we will get there will be determined by events.”

- The RBA’s inflation forecast seems wildly optimistic to me and I suspect rates at 2.5% won’t be enough to get inflation fully under control. Neutral interest rates in Australia are likely in the 2% to 2.5% range at the moment, meaning the RBA still has a long way to go to get to a deflationary setting and both political parties have clearly indicated that they will be pursuing expansionary fiscal policy for the foreseeable future. However, it is nice to see the RBA move to a more flexible setting. The concrete statements about future interest rates made over the last 12 months really didn’t work out for them.

- The market seems to agree that the RBA is still being too conservative, pricing in much higher rates than Mr Lowe has contemplated. At the moment the market is pricing in a cash rate of almost 4% in February 2024.

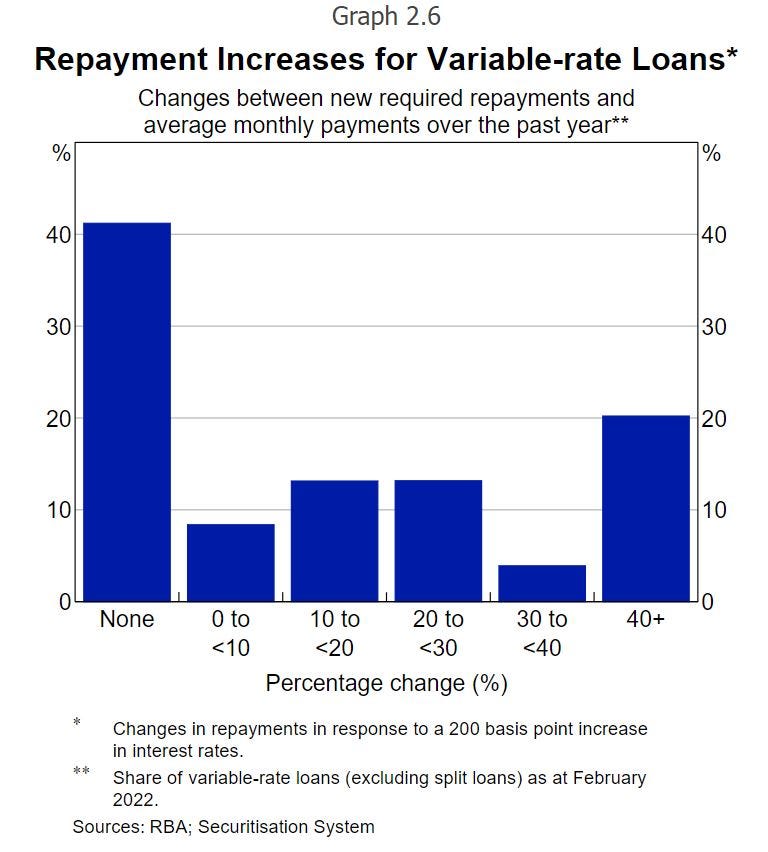

- It looks like Australian’s with mortgages have smartly moved to protect themselves from rate rises. This will mean rates will have to go higher for longer to get the desired effect on demand. Per the ABS, more than 40% of households with mortgages would see not change to their repayments were rates to increase by 200 basis points.

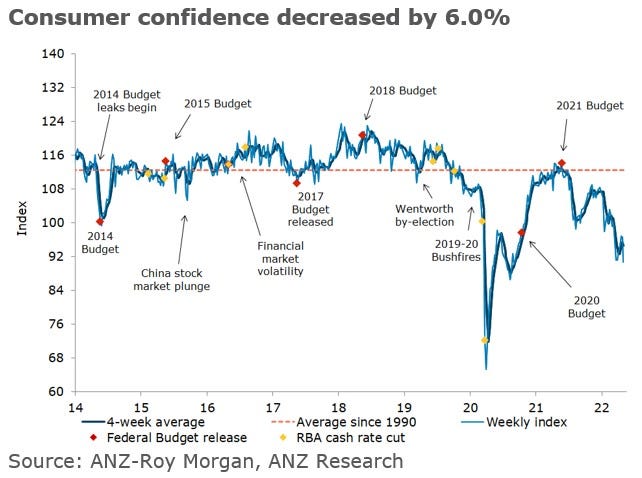

- Inflation fears and concerns about rate rises and costs of living were already starting to way heavily on consumer confidence before today’s rate decision. Overall confidence was down 6%, with confidence dropping 9.6% amongst people ‘paying off their home loan’, while for people who already own their home or are renting confidence dropped by 4.7% and 4.2% respectively. Will be interesting to see how the rate rise impacts confidence