Continued signs of strong inflation

A few more data points this morning that point towards inflation staying elevated and signalling that the RBA needs to do more with rate rises to slow the economy.

First, ANZ Research shows consumers spending continues to be well above trend, with no noticeable slowdown so far in 2022. I've previously highlighted the strong savings Australian households have, which will allow them to keep spending elevated long after interest rate increases start to bite (which the haven't yet). I expect we will be well into 2023 before we see a downturn in consumer spending on the current trajectory.

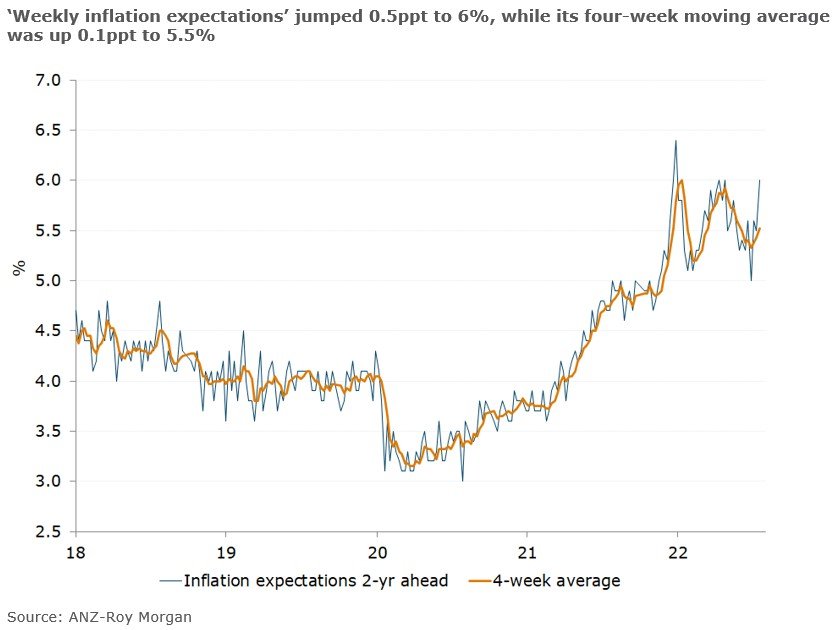

Second, inflation expectations (per ANZ-Roy Morgan) where up 0.5% to 6% in the wake of the RBA's dovish pivot. A clear demonstration of the risks associated with showing weakness and taking the foot of the gas when battling inflation. Higher inflation expectations tend to filter through as higher future inflation.

While the key data point for the RBA will be CPI figures out next week, it's looking increasingly likely that the 25bp increase this month was a mistake and an outsized 'catch-up' increase of 75bp will be the pragmatic move next month.