A Quick Update on the Economy

There's been a bunch of interesting economic information out over the the last few days that gives us an interesting insight into how the economy is going and what to expect going forwards.

Here are a few of the most interesting tidbits, all in easy to digest chart form.

Consumer Confidence is Low

The ANZ-Roy Morgan Consumer Confidence index is at very low levels and saw another significant decline last week. It's clear that consumers are worried about the combined impact of cost of living pressures, real wage declines, and more expensive mortgages and these concern continues to push confidence lower.

Consumer Spending is Holding Up

Despite the decline in consumer confidence, households are continuing to spend. Observed spending, as tracked by ANZ Research, is still broadly on trend with no significant impact being felt from the RBA's rate rises or falling real wages. In particular, spending on large scale discretionary item such as furniture and travel continue to grow, while the majority of other discretionary spending remained stable.

Australians aren't yet turning to short term sources of credit to fund the continued resilience in consumer spending either, with credit card balances remaining relatively flat through all of 2022.

Business Confidence is Up

Despite the low level of consumer confidence, business confidence has remained generally positive and surveyed business conditions continued to be strongly positive. Clearly there is a disconnect between the way consumers and businesses see the economy at the moment, with a large chunk of that difference explained by the ongoing robustness in consumer spending. (Source NAB Business Survey)

Business Prices Are Exploding

Businesses are seeing increasing pressure on prices, across both purchase costs and labour. The growth in labour costs is not surprising as continued low unemployment and the economy rapidly approaching capacity limits was bound to put upward pressure on wages. It's interesting to note the disconnect between labour costs as survey by NAB and the Wage Price Index, with the WPI currently lagging NAB's survey by almost 9% on an annualised basis. This is likely to flow through to wage growth in the future and put more pressure on the RBA to keep up with rate increases. (Source NAB Business Survey)

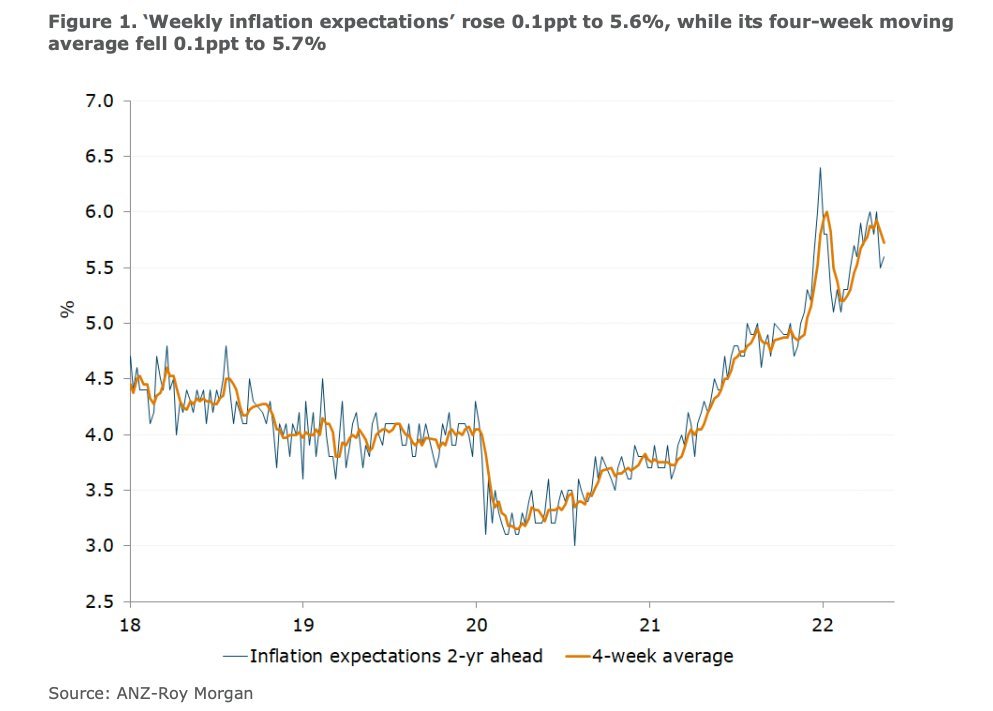

Inflation Expectations Could be Anchoring Higher

Inflation expects rebound in the last month to 5.6%. This means inflation expectations have now been anchored above 5.0% for almost a year, despite aggressive action from the RBA to tame inflation. This is going to be a significant concern for the RBA. The longer inflation expectations remain high, the more risk there is that expectations become anchored at these levels and we see lodger term inflation flow from pricing decisions and wage demands.