Blog

Read my writing about Business, Insolvency, Turnaround, and the Economy.

PJC Enquiry into Corporate Insolvency Reports

The Parliamentary Join Committee into Corporate Insolvency in Australia issued their report today and while their recommendations are generally all rowing in the right direction, its disappointing that the vast majority of them boil down to 'this committee recommends the government form another committee to undertake another review and make further recommendations'.

On the bright side, immediate recommendations around clarifying the treatment of trusts in insolvency, the collection of better data by the ASIC, and the ATO publishing model creditor guidelines are all welcome reforms, that if implements, will help right now.

And while I'm also happy to see the idea of a comprehensive review finally gain some traction, given all the time and effort that went into this enquiry, I had hoped to see a few more concrete recommendations that could be implemented immediately.

Overall, it was great to see the government devote this level of attention to a niche area of law like insolvency, but I think there is significant risk that as the current government gets further into this term, competing priorities will divert their attention and the proposed comprehensive review will just never happen. There are, frankly, a lot of bigger issues that are worth many more votes for them to devote their attention to, so it would have been better to bank a few more wins now, before there's any risk of the process losing momentum.

You can read the full report at: https://www.aph.gov.au/Parliamentary_Business/Committees/Joint/Corporations_and_Financial_Services/CorporateInsolvency/Report

May 2023 - Corporate Insolvency Appointments

There were 1070 corporate insolvency appointment in May 2023, pretty much bang on the long term average of 1069.

With May’s numbers now in, and June numbers tracking to also come in around the long term average, it’s clear that through the second half of 2023, appointments have recovered to where we would expect them to be. However, there certainly hasn’t been any huge wave of insolvencies yet, just a return to normal levels.

With economic conditions tipped to deteriorate next year, it’s highly likely that we will see appointments rise to historically ‘high’ levels next year (and we’ll see a whole new round of hysterical media articles).

Of the major appointment types, Voluntary Adminstrations, Voluntary Liquidations, and Receiverships have all returned to normal levels, while Court Liquidations reman at less than half their long term average. The new Restrucutruing appointment typy is making up the shortfall and to me this is a positive story, replacing the most terminal of appointments, with one designed to rehabilitate small businesses. Hopefully that trend can continue into next year.

Attorney General Enquiry into Personal Insovlency

Great to see personal insolvency also getting some government attention. Personally, I think reform here is more needed and urgent than in the corporate insolvency space.

The six key areas I'd like to see looked at:

1: Shortening or eliminating the 'term' of bankruptcy

The current bankruptcy term of three years is far too long and punitive. There have been proposals floating around for at least half a decade to shorten that term to one year, but I question whether a 'term' of bankruptcy is required at all. Changing bankruptcy to a point-in-time event that capture current debts and assets seems the cleanest solution to me.

2: Remove all prohibitions on managing a company

Currently bankrupts cannot be directors of a Company. This is arbitrary and should be removed. ASIC has the power to ban individuals from being a director if their conduct warrants it, and that is the better way for this outcome to be achieved.

3: Allowing cross appointments

Often business and personal dealing are intertwined and this can necessitate the liquidation of a company and bankruptcy of the directors. Currently that requires engaging and paying for two different professionals to complete these roles.

The law should allow the same professional to act as both liquidator and trustee in bankruptcy to simplify these kind of appointments, especially for small businesses.

4: Fix or Remove Income Contributions

A combination of low wage growth, high inflation, and indexing now means that only very high income earners now pay income contributions. This was clearly not the intention of the original scheme. We either need reform to fix contribution thresholds, or the removal of the scheme (which would fit well with a rethinking of bankruptcy as a point-in-time event rather than a period).

5: Make is cheaper and easier for creditors

Currently, making an individual bankrupt is a time consuming and expensive process for creditors. This process should be streamlined and simplified so that creditors can quickly and cheaply enforce their debts. This would go hand in hand with a reduction or elimination of most of the punitive aspects of the current bankruptcy regime (a move to a point-in-time bankruptcy), allowing both creditors and debtors to quickly resolve debt issues and get on with their lives and businesses.

6: An SBR style process for individuals

Personal insolvency laws currently have two 'restructuring' options. But neither are currently fit for purpose. The PIA process is too cumbersome and expensive, and the Debt Agreement process too rigid and inflexible. We need a flexible, SBR style process to allow individuals to cheaply and quickly deal with business debts.

https://www.afr.com/companies/financial-services/dreyfus-to-explore-urgent-changes-to-insolvency-laws-20230131-p5cgvp

Correcting Misinformation about Small Business Restructuring

Disappointing to see another article in the mainstream media spreading fear and misinformation about the Small Business Restructuring Process (SBR).

The main claim in the article, that the process is overly complicated, is just not true. While the legislation that governs the process has been drafted in a way that makes it difficult to follow, SBRs are an easy and straight forward process in practice.

While take up has been low, any supposed complexity is not the main driver of low appointment numbers. From my experience in the market place, three main drivers are making it difficult for small businesses to take advantage of the SBR process:

1: There is a general lack of awareness that they exist as an option. The government and ASIC have done a very poor job of teaching small business owners and their advisors that SBRs are an option to deal with debt.

2: In order to propose a Restructuring Plan, a company must have paid all employee entitlements. In 3 out of 5 of the companies that approach me about restructuring, this is the key impediment to restructuring. These businesses often have superannuation debts that accrued over the COVID period as a result of Job Keeper payments that they have no way of paying. This immediately prohibits them for entering the SBR process. A simple reform to allow employee debts to also be restructured (similar to what is allowed in the VA process) would solve this issue.

3: There is a cap on debts that can be restructured through an SBR of $1 million. Many businesses exceed this cap and accordingly cannot access the process. Unfortunately for these businesses, Voluntary Administration, the only alternative, costs at a minimum 3 to 4 times as much as an SBR costs, leaving these businesses with no viable option. The ASBFEO's proposal to increase the debt cap to $5 million would be a good start to resolve this issue.

The SBR process is a great innovation for Australian small businesses, providing them with a quick, cheap and effective restructuring option. I've seen how well in can work in the real world across a wide range of industries. However, the restrictions that the government put in place when they introduced the process are limiting the opportunity for small businesses to use the process.

Given the challenges facing the business community heading into 2023, loosening the restrictions would be the right way to improve SBRs and allow more business to take advantage of them, rather than a technocratic focus on simplifying legislation that already works just fine in practice.

https://www.smartcompany.com.au/business-advice/small-business-simplified-restructuring-scheme/

Insolvency appointments remain low

However, we’re headed for recession and more insolvency appointments.

Another quarter has flown by and it’s time to take another look at how insolvency appointment numbers are tracking and look into our crystal ball to see what the future might hold.

The current picture

First, let’s look at where insolvency appointments are at the moment.

Corporate insolvency

Corporate insolvency appointments are up.

In the first quarter of FY2023 appointments were up 60% on the same period last year and were much closer to historical levels than they have been over the last two years, with appointments averaging 840 per-month over the last three months.

Of particular note is the growing popularity of small business restructuring (SBR). So far this year, we have had 83 SBR appointments, more than we had in the first eighteen months following the introduction of SBRs.

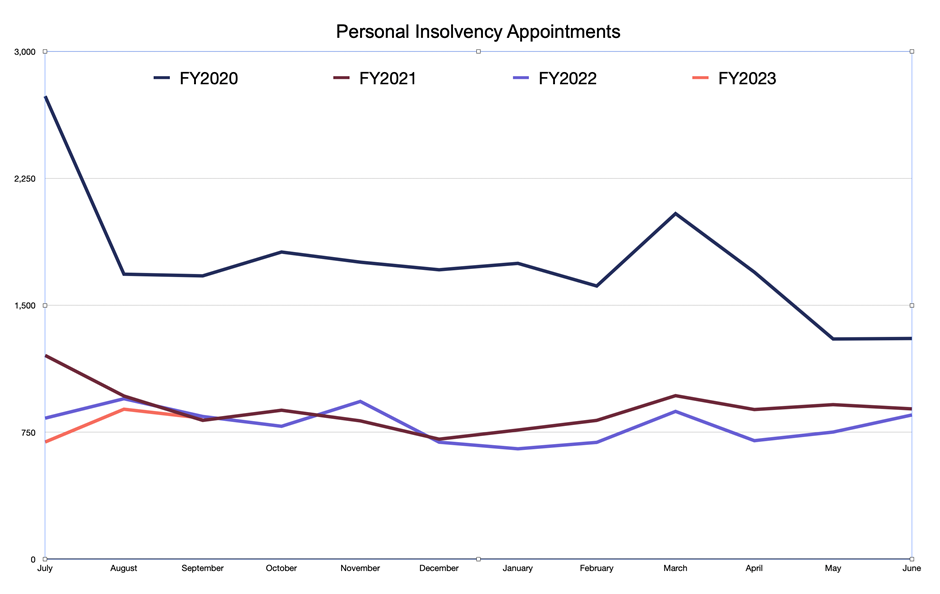

Personal insolvency

Personal insolvency appointments remain low.

In stark contrast to corporate insolvency appointments, personal insolvency appointments this financial year are lower than ever. This continues the depressed appointment numbers we have had over the last two years.

A strong economy

So, what’s going on? Why—Despite all the years of lockdowns, talk of zombie companies and business stress, and muted economic difficulties—has the number of insolvency appointments remained well below historical trends?

The main reason is, despite some headwinds, Australia’s economy is doing well and as long as this continues, insolvency appointments are likely to stay below the trend.

Business conditions remain strong

Business conditions, as measured by the NAB Quarterly Business Survey[iii] remain well above average. While businesses are facing some headwinds, in particular difficulties with staffing, the availability and cost of some supplies, and rising interest rates, trading conditions are good, which is keeping businesses from failing.

Consumer spending

Further to generally good business conditions, household spending remains very strong and well ahead of trend. Consumer spending has been elevated for all of 2022 so far, as low unemployment and strong household balance sheets have allowed people to get out and spend money at record rates.

I expect this trend to continue well into 2023. Australian households still have a huge war chest of excess savings (about $294 billion) , built up over the pandemic period, to deploy before they will be forced to tighten their belts.

Downside risks

Unfortunately, it’s not all good news. While the economy is doing well currently, businesses and households will face significant challenges over the longer run that will lead to an increase in insolvency appointments over the next two years.

ATO debt collection

The Australian Taxation Office (ATO) restarted its debt collection processes, after a long hiatus during the pandemic period. As at December 2021, the ATO's debt book was $61.4B, up 16% from the year before; and the ATO will need to work through and collect this debt over the coming years. The ATO has issued about 7,000 director penalty notices (DPNs) this year and is issuing more at a rate of 300/ business day. The ATO has also recommenced filing wind up applications. The ATO has filed 35 wind up applications so far this financial year, already a significant increase on the 10 filed in all of FY 2020-21, but still a long way short of the 3,571 the ATO filed in FY2015-16.

This pressure will have a dual impact on insolvency appointments. First, direct pressure, as the ATO pushes businesses into an insolvency appointment following its debt collection activities; and secondly, as other creditors who have also withheld from firmer debt collections activities, now feel comfortable resuming firmer action following the ATO’s.

Inflation and interest rates

Inflation continues to be a problem, with the most recent result, for September, showing inflation running at 7.3% per annum and continuing to accelerate. Forecasts are for inflation to remain well above the RBA’s target range of 2.00% to 3.00% for two more years.

As a result, we will see interest rates continue to rise as the RBA takes action to bring inflation back down to the target range. Currently, the RBA’s cash rate is 2.60%. However, markets are implying we will see a peak rate for 4.20% in late 2023. This will place significant pressure on household budgets, which will flow through to business conditions.

Real wages are falling fast

The other downside risk for household spending, and thus the fundamentals underpinning the entire economy, is the rapid fall we are seeing in real wages. A combination of sluggish wage growth and high inflation has seen real wages fall to 2010 levels over the last 18 months.

This fall in real wages (especially if it continues) will eventually flow through to household spending and lead to a significant decline in business conditions, leading to more corporate and personal insolvency.

Recession?

The final factor that will lead to increased insolvency appointment numbers over the next two years is that our economy is very likely to slip into recession near the end of 2023 or in early 2024. The historical precedent is clear, periods of high excess inflation always require a recession to being broad-based inflation under control.

The global economy is slowing and likely going into recession in mid-2023 combined with domestic factors driven by a combination of households exhausting excess savings, declining real wages, and rising unemployment and interest rates will continue to put pressure on household budgets; leading to a decline in consumer spending and conditions for business, which will ultimately push our economy into a short recession.

While a recession will lead to higher insolvency appointment numbers, I do not expect to see levels as high as we saw during previous downturns.

It’s pretty clear that a downturn is coming, and the current positive trading conditions will allow many businesses to take steps to position themselves to better weather the storm, and I also expect the recession to be relatively short and shallow, meaning the impact will be limited.

References

[i] Australian Securities and investments Commission – insolvency Statistics (current) – Series 2 - https://asic.gov.au/regulatory-resources/find-a-document/statistics/insolvency-statistics/insolvency-statistics-current/

[ii] Australian Financial Security Authority - monthly personal insolvencies - https://www.afsa.gov.au/about-us/statistics/monthly-personal-insolvency-statistics

[iii] NAB Quarterly Business Survey - September 2022 - https://business.nab.com.au/nab-quarterly-business-survey-september-2022-56500/

[iv] ANZ Research - https://www.anz.com/institutional/our-expertise/anz-research/

[v] ASX - https://www.asx.com.au/data/trt/ib_expectation_curve_graph.pdf

ATO Debt Book Explodes

The ATO's annual report for FY2022 is out and that means we get a look at jus show much debt the ATO has sitting on its books.

Over the pandemic period, when the ATO effectively stopped enforcing debts, unpaid tax ballooned from $26.5 billion at 30 June 2019 to $44.8 billion as at 30 June 2022. Small businesses are the largest segment, with collectable debts owing of $29.3 billion

While the ATO has tentatively restarted its 'firmer and stronger actions' debt recovery program, it's going to take a long time to work through the backlog.

Personal Insolvencies - September 2022

Personal insolvency numbers for September 2022 were released by AFSA this afternoon, and it's pretty much a repeat of the last two months.

In September there were 833 Personal Insolvencies, made up of:

🎃 501 Bankruptcies

🎃 317 Debt Agreements

🎃 10 Personal Insolvency Agreements

🎃 5 Deceased Estates

Personal insolvencies remained at near record lows for yet another month, mainly as the result of a super strong jobs market, low unemployment, and strong household balance sheets. Despite rising interest rates and rising cost of living, individuals aren't feeling the financial pinch quite yet.

There has also been a structural move in the personal debt collection market away from using bankruptcy as a recovery tool, with sequestration orders still down more than 50% from their pre-pandemic levels, despite moratoriums being lifted for over a year now.

Will bankruptcy numbers continue to stay this low? Almost certainly not, however the Australian economy, and especially Australian households, still have a lot of strength to withstand rate increases and a deteriorating global economy, so I don't expect to see any significant increase until at least Q2 2024.

August 2022 Personal Insolvency Appointments

Personal insolvency stats are out for the month of August 2022 with 886 new appointments. While up 17% from last month's ultra-low numbers, this is still a 7% decline on August 2021 and keeps personal insolvencies at record lows.

Breaking the appointments down there were:

⚠️ 515 Bankruptcies

⚠️ 361 Debt Agreemetns

⚠️ 9 Personal Insolvency Agreements

⚠️ 1 Insolvent deceased Estate

22% of personal insolvencies in August were business related, which is a bit lower than the long term average of around 28%, but inline with recent months.

Following the pick up in corporate insolvency appointments through July and August 2022, I had expected to see personal insolvency appointments starting to rise as well. Both numbers are historically fairly closely correlated. However, that hasn't been the case. This could mean personal insolvency appointments are just lagging corporate appointments a bit, or it could be a sign of a new normal, where personal insolvency appointment numbers are just lower than we are used to.

Source: https://www.afsa.gov.au/about-us/statistics/monthly-personal-insolvency-statistics

FY2023 Insolvency Update

We are 8-weeks into FY2022 and now have a bit of data, so its a good time to check in on corporate insolvency appointment numbers.

After two years of well below trend appointment numbers, appointments are now back to long term trend levels so far in FY2022.

Creditor's Voluntary Wind-ups accounted of the vast majority of the increase in appointments, with CVL's up 80% on the same period last year. Anecdotally, a lot of this is driven by the ATO's increased issuing of DPNs.

Small Business Restructuring has also seen increasing popularity with 43 appointments in the last 8-weeks (up from 5 in the same period last year). It's great to see Director's starting to take advantage of this option to restructure, rather than wind up their business.

All stat from ASIC Series 2B - Weekly Insolvency Statistics

Corporate Insolvency Market Report

Insolvency Australia have another excellent report out overnight summarising the corporate insolvency market for FY2021-22.

It's great to see Worrells still on top as the most appointed corporate insolvency firm in Australian last year 🥳

It's also interesting to see how many appointments from outside NSW are being taken by NSW based appointees. ASIC stats record 1,830 NSW based companies entering external administration last financial year, while Insolvency Australia's report shows NSW based appointees accepting 2,819 appointments.

You can download the full report here.