Blog

Read my writing about Business, Insolvency, Turnaround, and the Economy.

A First Decision on Creditor-Defeating Dispositions

The creditor-defeating dispositions provisions have had what is, to my knowledge, their first outing, with the Victorian Supreme Court handing down a decision in Re Intellicomms Pty Ltd (in liq) [2022] VSC 228 (11 May 2022), voiding a sale of the company’s business to a related entity.

The creditor-defeating dispositions provisions were introduced, as a new class of voidable transactions, in 2020 as part of a package of legislation to combat illegal phoenix activity.

The creditor-defeating dispositions provisions have had what is, to my knowledge, their first outing, with the Victorian Supreme Court handing down a decision in Re Intellicomms Pty Ltd (in liq) [2022] VSC 228 (11 May 2022), voiding a sale of the company’s business to a related entity.

The creditor-defeating dispositions provisions were introduced, as a new class of voidable transactions, in 2020 as part of a package of legislation to combat illegal phoenix activity. The provision is found in section 588FBD of the Corporations Act, and the key part for this case is found in subsection 1:

(1) A disposition of property of a company is a creditor-defeating disposition if:

(a) the consideration payable to the company for the disposition was less than the lesser of the following at the time the relevant agreement (as defined in section 9) for the disposition was made or, if there was no such agreement, at the time of the disposition:

(i) the market value of the property;

(ii) the best price that was reasonably obtainable for the property, having regard to the circumstances existing at that time; and

(b) the disposition has the effect of:

(i) preventing the property from becoming available for the benefit of the company’s creditors in the winding-up of the company; or

(ii) hindering, or significantly delaying, the process of making the property available for the benefit of the company’s creditors in the winding-up of the company.

On the face of it, the fact in this case are pretty suspicious. Intellicomms operated a business providing translation services to businesses in Australia and New Zealand. On 8 September 2021, the company transferred its business to a related entity that had been incorporated just two weeks before the transaction. Intellicomms was put into voluntary liquidation on the same day the transaction was completed.

The Liquidators sought to have the Sale Agreement set aside as a creditor-defeating disposition within the meaning of s 588FDB of the Act, and a voidable transaction within the meaning of s 588FE(6B) of the Act.

While the business had been sold following a valuation, its Director had obtained several valuations in the months before the sale, providing the valuers with increasingly pessimistic inputs as to future trading revenue. This caused the valuations to decrease from over $11 million in the first one obtained, to only $57,000 for the one relied upon to sell the business.

The Judge, not surprisingly, found the transaction to be a creditor defeating disposition, opining:

“I consider that the Sale Agreement has all the features of what has become known as a phoenix transaction; indeed, it is a brazen and audacious example. The effect of the Sale Agreement was to strip Intellicomms of what assets it had to satisfy the claims of its creditors and transfer them to an entity which was closely associated with its director”

With such a straightforward set of facts, we don’t get much in the way of interesting clarification of how the provisions will work in practice, however, there was one interesting point made. His Honour expressed the view that Liquidators are only required to establish that, on the balance of probabilities, the consideration payable under the Sale Agreement was less than the market value or the best price that was reasonably obtainable and that there was no onus on the Liquidators to evidence actual values.

It’s great to see these new provisions get a successful outing. They provide another useful tool in the Liquidators toolbox to combat phoenix activity.

An Update on Debt Collection Activity

After a long hiatus over the pandemic period debt collection activities across the economy are slowly starting to return to normal levels. While the number of corporate insolvencies, bankruptcies and wind-up notices remain well below historical levels, they are slowing increasing. Here’s a quick update about what I am seeing and hearing around the industry.

After a long hiatus over the pandemic period debt collection activities across the economy are slowly starting to return to normal levels. While the number of corporate insolvencies, bankruptcies and wind-up notices remain well below historical levels, they are slowing increasing. Here’s a quick update about what I am seeing and hearing around the industry.

The ATO

The ATO broke their silence on their debt collection activities last Friday, confirming that they are ramping up debt collection activity while still focusing on providing support and assistance to those with overdue debts. The ATO advised that they would be continuing to use a collaborative approach with most taxpayers and, for the moment, firmer action would only be taken where taxpayers aren’t receptive to communication.

The ATO confirmed that they have issued 29,552 awareness letters for disclosure of business tax debts and 52,319 awareness letters about the use of Director Penalty Notices (“DPNs”). Word on the street is that the ATO has identified around 150,000 small businesses that require compliance attention and that they intend to issue a further 50,000 DPN warning letters through the end of the financial year.

While this is a definite step up from where the ATO was during the pandemic, this still represents a very soft approach to debt collection and is a long way from the ATO’s stated goal of ensuring that there is no unfair advantage to non-payers.

In my experience that ATO has remained very open to doing deals to compromise tax debts that accrued through the pandemic, especially through formal processes like Small Business Restructuring or Voluntary Administration. However, I am also hearing that their patience is running out, and in particular, several clients have been told that the current payment plan will be the last that the ATO is willing to offer them.

I expect the ATO will slowly ramp up activity over the next 18 months, progressively increasing their compliance activities as time goes by. That being said, now is the time to do deals, before the ATO moves from the current support setting and starts focusing more on collecting outstanding tax debt.

Landlords

I’m seeing landlords start to take action to recover rent that was deferred during the pandemic period. I suspect this is going to be a bit of a balancing act for landlords for a while, as the desire to collect deferred rent conflicts with a desire to hang onto existing tenants in a relatively weak rental market. This will especially impact landlords holding retail, hospitality and commercial office space.

Like with the ATO, I am seeing a general willingness from Landlords to do deals to compromise deferred rent. In particular, now is a great time for businesses to proactively reach out to their landlords and seek to negotiate a settlement on any deferred rent. I’ve seen some great results from this approach.

Institutional Creditors

There are also starting to be signs of debt collection action from institutional creditors. Some companies are starting to take steps to return to a more normal debt collection setting, including instructing agents and selling debt books for collection. I’m also hearing that some of the major institutional creditors are starting to talk about lifting the bans they placed on ‘firmer action’ during the pandemic period.

Banks and Mortgages

Except in extreme circumstances, I’m not seeing a lot of movement from the major banks either on business debt or mortgages with arrears. I expect the major banks will be the most conservative of the creditors and the slowest to restart their normal debt collection processes. Particularly with mortgage debt, the banks have built up significant LVR buffers with most clients and overall mortgage stress remains low, meaning something significant will have to change for the banks to risk the political fallout from a round of foreclosures.

We Crashed

Apple TV’s excellent series on the rise and fall of WeWork finished up recently. The series follows the founders of WeWork through its rise from a tiny co-working start-up to a $45 billion Unicorn and its rapid implosion and eventual bailout in 2019.

Apple TV’s excellent series on the rise and fall of WeWork finished up recently. The series follows the founders of WeWork through its rise from a tiny co-working start-up to a $45 billion Unicorn and its rapid implosion and eventual bailout in 2019.

For those who don’t know the story, WeWork was founded by Adam Neumann and Miguel McKelvey in 2010 in the wake of the GFC with the idea to repurpose empty office space into co-working spaces for freelancers and start-ups. At the time the idea was novel, that you could rent a desk for as long or as little as you needed, anywhere in the world. But the hype quickly overtook the reality of what was just a clever real estate play. WeWork marketed itself as a tech company, made bold claims about changing the world and branded its offices as ‘physical social networks’. WeWork grew rapidly, fuelled by billions of investor money, eventually reaching a valuation of $45 billion. However, the wheels came off when the Company attempted to go IPO and the resulting public scrutiny of its business model, truly amazing losses, and questionable management.

The show is very entertaining and it provides a great look at the particular kind of crazy that is needed to found and manage a high growth startup like WeWork. I highly recommend it, it’s a fun, fast-paced and well-told story.

However, while watching the last few episodes, which document the death spiral and eventual implosion of WeWork, I couldn’t help but see some parallels with some of the clients I see day to day at Worrells, albeit on a much smaller scale.

As WeWork began to get into financial difficulty, the leadership team ignored the advice of their investors and expert advisors and instead doubled down on a strategy that was the reason they were in financial trouble in the first place. Rather than slow their growth and take some time to consolidate the dominant market position they had built, WeWork continued to pursue a high cost, high growth strategy, convinced that at some point all of its unprofitable venues would just magically become profitable.

It reminds me of this old cartoon…

The first rule when you find yourself in a hole is to stop digging. Unfortunately, I often see business owners who, like WeWork, have dug themselves a financial hole and rather than stopping digging, by changing strategy or restructuring with the help of an expert advisor, they choose to keep on digging hoping that it will all just ‘come good’.

One of the great things about business is that you get concrete and timely feedback about what is and isn’t working. What is making money and what isn’t, what is selling and what isn’t, what is getting customer attention and what isn’t. This gives us actionable intel on what we need to look at changing to make a business better.

While most business owners read the signs, get good advice, and turn their business around, unfortunately, it isn’t everyone and businesses still fail needlessly, affecting the lives of directors, investors and employees.

Unfair Preferences and the High Court

It was a strangely busy day for the High Court today when it comes to considering cases related to unfair preferences, with movement on both the ‘Peak Indebtedness’ rule and 553C Set-off.

It was a strangely busy day for the High Court today when it comes to considering cases related to unfair preferences, with movement on both the ‘Peak Indebtedness’ rule and 553C Set-off.

Peak Indebtedness

Submissions were published in the matter of Bryant & Ors v. Badenoch Integrated Logging Pty Ltd

As many of you will recall, on 10 May last year, the Full Court of the Federal Court of Australia (“FCFCA”) handed down a decision that the ‘peak indebtedness rule’ which has been a long-standing precedent in preference claims, was abolished with the introduction of section 588FA of the Corporations Act (“Act”). You can read about that decision at https://www.linkedin.com/pulse/peak-indebtedness-rule-preference-claims-abolished-brendan-giles/

The decision has been appealed to the High Court and we finally get a look at the submissions by the appellant.

The submissions are focused on two grounds:

(a) In enacting section 588FA of the Act, did Parliament intend to abrogate a liquidator’s right to choose any point during the statutory relation back period, including the point of peak indebtedness, in an endeavour to show that from that point there was an unfair preference (the peak indebtedness rule)?

(b) Will a continuing business relationship, within the meaning of section 588FA(3) of the Act, cease if the operative and mutual purpose of inducing further supply of goods or services is subordinated to a predominant purpose of recovering past indebtedness?

Clarity on both these points will go a long way to clearing up the lingering uncertainty in this space following the FCFCA decision.

As I’ve said previously, I found the decision by the FCFCA is a more equitable approach. I have never seen an equitable justification for allowing the Liquidator to choose a date that maximised the preference claim and nothing in the submissions in compelling enough to make me change my mind.

553C Set-off

The High Court also granted an application for special leave to appeal in the decision of the FCFCA in the matter of MJ Woodman Electrical Contractors Pty Ltd v Metal Manufactures Pty Ltd [2021] FCAFC 228.

In that case the FCFCA clarified the, until then, quite confused law around the availability of set-off as a defence to an unfair preference claim, confirming that set-off was not available as a complete or partial defence for a creditor facing an unfair preference claim.

While we won’t see submission on this one for a while, it will be interesting to see the basis upon which the appeal in being made. I personally think that the FCFCA got this one right as well and expect that the High Court will be more likely to remove any doubt around the issue, rather than to overturn the FCFCA’s decision.

A few takeaways from yesterday’s interest rate decision by the RBA

As well as bumping rates, the RBA made a huge revision to their forecasts, with the central forecast now predicting headline inflation of around 6.00% and underlying inflation of around 4.75% by the end of 2022 before a steady decline.

- As well as bumping rates, the RBA made a huge revision to their forecasts, with the central forecast now predicting headline inflation of around 6.00% and underlying inflation of around 4.75% by the end of 2022 before a steady decline. Their previous forecast was 2.75% made in February this year. This new forecast is also a long way from the government’s forecasts that underlined the budget last month. It’s somewhat concerning that both treasury and the RBA got it so wrong only a couple of months ago.

- Lowe made some interesting comments in his press conference after the decision: “It’s not unreasonable to expect that interest rates could rise to 2.5%”. He followed up with “How quickly we get there and if we do get there will be determined by how events unfold. We have an open mind, over the past two years we have been very flexible, it changed in response to changing circumstances and we will continue to do that… a more normal level. How fast we will get there will be determined by events.”

- The RBA’s inflation forecast seems wildly optimistic to me and I suspect rates at 2.5% won’t be enough to get inflation fully under control. Neutral interest rates in Australia are likely in the 2% to 2.5% range at the moment, meaning the RBA still has a long way to go to get to a deflationary setting and both political parties have clearly indicated that they will be pursuing expansionary fiscal policy for the foreseeable future. However, it is nice to see the RBA move to a more flexible setting. The concrete statements about future interest rates made over the last 12 months really didn’t work out for them.

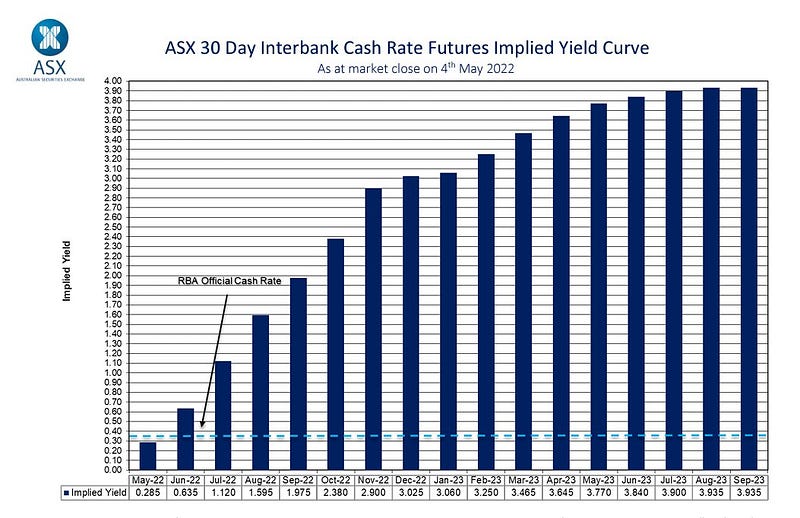

- The market seems to agree that the RBA is still being too conservative, pricing in much higher rates than Mr Lowe has contemplated. At the moment the market is pricing in a cash rate of almost 4% in February 2024.

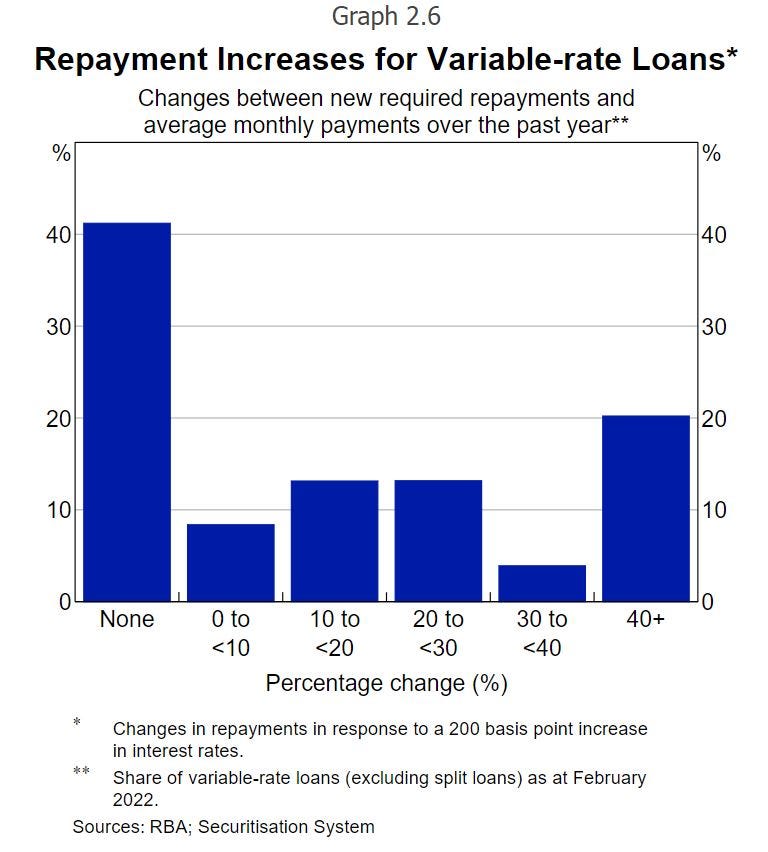

- It looks like Australian’s with mortgages have smartly moved to protect themselves from rate rises. This will mean rates will have to go higher for longer to get the desired effect on demand. Per the ABS, more than 40% of households with mortgages would see not change to their repayments were rates to increase by 200 basis points.

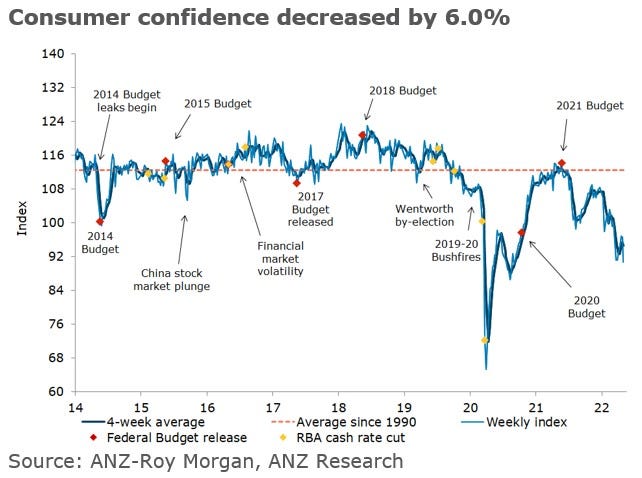

- Inflation fears and concerns about rate rises and costs of living were already starting to way heavily on consumer confidence before today’s rate decision. Overall confidence was down 6%, with confidence dropping 9.6% amongst people ‘paying off their home loan’, while for people who already own their home or are renting confidence dropped by 4.7% and 4.2% respectively. Will be interesting to see how the rate rise impacts confidence

Inflation has gotten out of control while the RBA has been asleep at the wheel

Australia’s consumer prices were up 5.1% in the March quarter of 2022. Quite a bit more than the RBA was predicting and above the estimates of almost all the experts. While the headline number is shocking, its the highest it’s been in 20 years, reality is even worse.

The March quarter figures sill bake in couple of quarters effected by reduced activity as a result of COVID-19 lockdowns. If we normalise those quarters we get an eye watering annualise inflation rate of 8.67% to March 2022.

Australia’s consumer prices were up 5.1% in the March quarter of 2022. Quite a bit more than the RBA was predicting and above the estimates of almost all the experts. While the headline number is shocking, its the highest it’s been in 20 years, reality is even worse.

The March quarter figures sill bake in couple of quarters effected by reduced activity as a result of COVID-19 lockdowns. If we normalise those quarters we get an eye watering annualise inflation rate of 8.67% to March 2022.

A couple of takeaways…

First, there has been a lot of talk about the current bout of inflation being due to external factors like supply chain crunches, wars, and general global dislocation due to COVID. This line of reasoning is wrong. 100% of excessive inflation is due to bad monetary policy. Always! This is true for every respectable theory of economics (be it Keynesian, Austrian, monetarist etc).

It’s the RBA’s job to keep inflation under control. It’s been obvious for at least eighteen months that the unprecedented stimulus provided by the Australian Government would lead to growth in nominal spending once lockdowns ended and people could go out and spend all the money they had been saving while stuck in lockdown. Supply side issues just exacerbated the demand side issues, and when wages finally start playing catch up, inflation is only going to go higher. The RBA missed the boat by not normalising interest rates early to avoid an inflation blowout.

Second, the RBA has to raise rates at their meeting next week. A cash rate of 0.1% is clearly no longer appropriate for our economy. The market is expecting an increase, with a rate rise to 0.25% fully priced in and a 25% chance of an increase straight to 0.5%. If the RBA decides to sit on their hand yet again, they will lose all credibility.

I personally hope we see a strong move by the RBA, directly to 0.5%. Managing inflation is as much about the message that the RBA gives to the market than the actual interest rate moves it makes, and a large move so closely linked to the release of inflation data will send a strong message that the RBA is serious about controlling inflation this cycle.

2022’S MAJOR BUSINESS CHALLENGES THAT WILL DRIVE AN INCREASE IN BUSINESS FAILURES

WE’RE IN FOR A WILD RIDE! AND MORE INSOLVENCIES WILL BE PART OF THE PRICE.

We all know the story by now, insolvencies have been down on the long-term average for two years now and so far, at least, we aren’t seeing much of an uptick. While the mood around the industry is that the tide is starting to turn, this isn’t being borne out in the hard numbers yet.

WE’RE IN FOR A WILD RIDE! AND MORE INSOLVENCIES WILL BE PART OF THE PRICE.

We all know the story by now, insolvencies have been down on the long-term average for two years now and so far, at least, we aren’t seeing much of an uptick. While the mood around the industry is that the tide is starting to turn, this isn’t being borne out in the hard numbers yet.

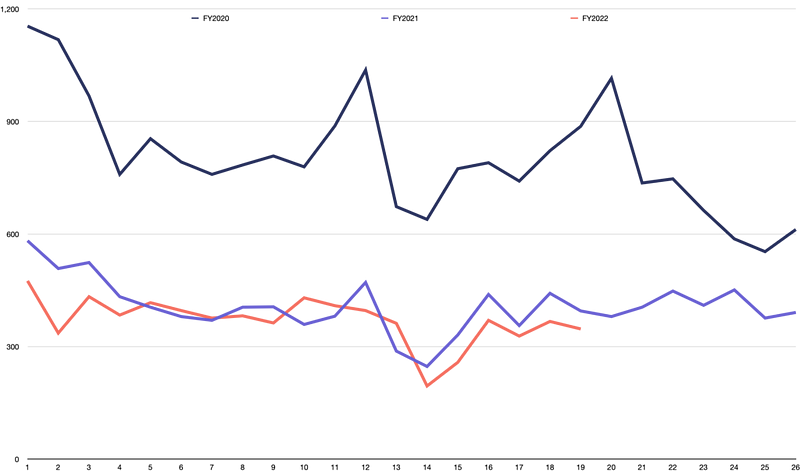

Corporate insolvency appointments for the year to date remain down approximately 35% on historical levels, exactly the same decrease we saw at the same time in 2021.

Source: ASIC — Series 1B Notification of companies entering external administration and controller appointments — weekly.

In the personal insolvency space, the story is the same, with the number of appointments slightly lower than 2021 and still less than 50% of the long-term average.

Source: AFSA’s Provisional annual personal insolvency statistics 2020; 2021; 2022.

Despite actual appointments still being sluggish, the consensus across the industry is that enquiry levels have increased substantially in 2022 and the insolvency market looks to be moving back towards normal appointment volumes.

Let’s take a quick look at the major challenges businesses are likely to face over the rest of 2022 that will drive an increase in business failures.

The debt collection holiday is over

The Australian Taxation Office (ATO) historically was Australia’s most active creditor. The ATO filing winding-up applications against companies and issuing director penalty notices (DPNs) and statutory demands were a significant catalyst for both voluntary liquidations and companies restructuring.

When COVID-19 hit in early 2020, the ATO halted its debt recovery action. The ATO has now restarted its debt collection activities, addressing the backlog of tax debt accrued over the last two years but expects that it will take a couple of years to catch up. Therefore we expect to see ATO action resulting in more insolvency appointments than we’ve traditionally seen.

Other creditors who deferred debts in support of SMEs through the pandemic period are reverting to normal debt collection practices. In particular, we are starting to see landlords take steps to recover the rent deferred during the pandemic.

Uncertainty in supply chains

One of the other big factors causing businesses difficulty is the continuing uncertainty in supply chains. This has made it difficult for businesses to get the supplies needed to run their business and is more expensive when supplies can be obtained.

The rising costs of building materials was a key factor in the recent high-profile failure of both ProBuild and Condev. These supply chain issues will continue for some time, with the war in Ukraine and associated sanctions, China’s ongoing commitment to COVID-Zero, and structural issues in the global supply chain are expected to continue influencing supply chains beyond 2022.

Inflation and interest rates

Hand in hand with supply chain issues is inflation increasing, forecasted at 4.9% over the next two years. This will put pressure on business through rising costs and wage increases that will flow from that.

Also expected is the Reserve Bank of Australia raising interest rates this year, with rates likely to rapidly return to more ‘normal’ levels around 2% in the next 12 to 18 months. This will add pressure by increasing business’s debt servicing costs, while also reducing disposable income that consumers have to spend.

Australians have very high levels of household debt, meaning the impact of interest rate rises on disposable income is significant. A 2% increase in interest rates would result in a 10% reduction in household disposable income meaning they have less money to spend in local businesses.

What this means for insolvency appointments

In short, both corporate and personal insolvency appointments will increase. We expect to see insolvencies pick up after the May election and to peak at well above historical levels in early- to mid-2022 as the combined impact of more difficult business conditions, less accommodating creditors, and the hangover from pandemic trading conditions combine to produce a uniquely and profoundly difficult environment for SMEs.

Cutting Fuel Excise is Pointless

It look almost certain at this point that tomorrow’s budget will include a reduction in petrol excise to ‘ease cost of living pressure’. Our federal government isn’t the only one jumping at this shadow. Governments from the USA to France have also rushed to take action to reduce petrol prices at the pump.

The problem is these polices are counterproductive. High petrol prices aren’t a problem to be fixed, they are the solution to demand exceeding supply in the oil market. Higher prices reduce demand and bring it in line with the current constrained supply.

It look almost certain at this point that tomorrow’s budget will include a reduction in petrol excise to ‘ease cost of living pressure’. Our federal government isn’t the only one jumping at this shadow. Governments from the USA to France have also rushed to take action to reduce petrol prices at the pump.

The problem is these polices are counterproductive. High petrol prices aren’t a problem to be fixed, they are the solution to demand exceeding supply in the oil market. Higher prices reduce demand and bring it in line with the current constrained supply.

Cutting taxes on petrol will reduce the price at the pump, which will increase demand. Oil prices will react by increasing further until we get back to equilibrium, with pump prices right back where they were. A cut to fuel excise achieves nothing and is actually counter productive. It costs the government much needed revenue, does nothing to reduce prices at the pump, and undermines the sanctions against Russia by increasing the value of their oil exports. And that’s without mentioning the positive impact on global greenhouse emissions that expensive oil is likely to bring.

Labour force statistics for February 2022

Labour force statistics for February are out today and it’s pretty much universally good news.

Labour force statistics for February are out today and it’s pretty much universally good news.

Let’s hit the highlights:

> Headline unemployment is down to 4% (from 4.2% last month), the lowest level since just before the GFC in 2008.

> Total people employed was up another 77,400, with the increase driven by full-time employment (up 121,900), while part-time employment fell by 44,500. More people in full-time jobs is great news for job security.

> The participation rate continued its upward trend, increasing from 66.2% to 66.4%, the highest level we’ve seen in a decade.

> The underemployment rate was also down, a reflection of the increase in full-time employment. Falling 0.1% to 6.6%. Equalling the lowest rate in a decade.

> The unemployment rate for women, at 3.8%, was the lowest since May 1974.

The only small blemish was that the number of employed people who worked no hours due to illness or sick leave remained high, up more than 80% on the long term average for February. While COVID case number have remained relatively low, it’s clear that isolation rules continue to have an impact on worker availability. This is likely to remain a problem for a while, as COVID cases again look to be on the rise and we are head into what is predicted to be a difficult Cold and Flu season.

While these figures are great, they do indicate that the economy is approaching capacity. This means we will see both accelerated wage growth and accelerated inflation until tightness in the employment market starts to ease. This means those tipping several interest rate rises this year are looking more and more likely to be correct.

Read the full report at: https://www.abs.gov.au/statistics/labour/employment-and-unemployment/labour-force-australia/feb-2022#underemployment

The Fed Finally Increases Rates

The US Federal Reserve has finally moved on interest rates, increasing the federal funds rate by 25 basis points to 0.25%. The Fed also indicated that they expect to keep increasing rates until they get to 1.75% to 2.00%, or back to the ‘natural rate’. The Fed also announced that they would be cutting back their bond purchasing program.

The US Federal Reserve has finally moved on interest rates, increasing the federal funds rate by 25 basis points to 0.25%. The Fed also indicated that they expect to keep increasing rates until they get to 1.75% to 2.00%, or back to the ‘natural rate’. The Fed also announced that they would be cutting back their bond purchasing program.

While this is clearly a move to bring inflation under control, the Fed remains optimistic that they won’t be pushing rates up aggressively, and sacrificing jobs and growth to get inflation under control. Rather than increasing rates aggressively to reduce demand and ‘tank’ the economy to get inflation under control, the Feb believes that a gentle correction in rates coupled with the economy returning to ‘normal’, as the COVID and war induced supply shocks ease, will be sufficient to bring inflation down. They have also indicated an appetite to allow the economy to run hot for an extended period of time to allow these factor to play out.

This is a risky move akin too playing with fire. By taking such a cautious approach, the Feb continues to run the risk that inflation gets out of control and a more aggressive correction is ultimately required to bring inflation back to sustainable level. The gamble might pay off, but the costs will be high if they have miscalculated.

The move by the Fed will also pave the way for the Reserve Bank of Australia to start its cycle of interest rate increases. While inflation has not reached the same levels in Australia as it has in the USA, the factors influencing the economy are largely the same and we can see in the USA a vision to the high inflation future that faces Australia if the RBA continues to sit on its hands.