Blog

Read my writing about Business, Insolvency, Turnaround, and the Economy.

Court Vests Disclaimed Property in Trustee

It’s not often you get to be involved in setting a new legal precedent. Personally, in my almost 20 years working in the insolvency and turnaround industry, I’ve only had a few occasions where we have been successful in creating some new law. Happily, I can add another case to the record.

In a recent decision, the Federal Court made Orders vesting the Bankrupt’s interest in a real property in the Trustee in Bankruptcy, despite a disclaimer of the property being made by the Former Trustee of the bankrupt estate.

It’s not often you get to be involved in setting a new legal precedent. Personally, in my almost 20 years working in the insolvency and turnaround industry, I’ve only had a few occasions where we have been successful in creating some new law. Happily, I can add another case to the record.

In a recent decision, the Federal Court made Orders vesting the Bankrupt’s interest in a real property in the Trustee in Bankruptcy, despite a disclaimer of the property being made by the Former Trustee of the bankrupt estate.

The facts in this case were rather unique. The former Trustee was appointed way back in 2009. At the time, the bankrupt owned real property with his non-bankrupt spouse. The Property was subject to a mortgage by the NAB and, after payment of the mortgage and costs, it was expected that there would be no equity available in the Property. The NAB had also obtained orders for possession and sale of the Property, advised they would be taking their own recovery action. Accordingly, the Trustee, seeing little chance of a return from the Property, disclaimed his interest.

Fast-forward 13 years and Aaron Lucan of Worrells had taken over as Trustee of the Bankrupt Estate, the Bankrupt had still not been discharged because he hasn’t lodged his Statement of Affairs, and the NAB had also not acted on their orders for possession and sale. Then, in September 2021, the NAB elected to discharge their mortgage, leaving the Property unencumbered.

The property now had significant equity available, so the New Trustee applied to the Court, pursuant to Section 133(9) of the Bankruptcy Act, (“Act”) to have the bankrupt’s former interest in the Property vested in him.

Section 133(9) provides the Court with a discretion to make various orders concerning the vesting or delivery of disclaimed property. There are several conditions which must be satisfied before the discretion is enlivened:

(1) there must be disclaimed property;

(2) there must be an application by a person either: (a) claiming an interest in the disclaimed property; or (b) under a liability not discharged under the Bankruptcy Act in respect of the disclaimed property; and

(3) the Court must have heard such persons as it thinks fit.

Conditions 1 and 3 were satisfied without debate, however, at issue was whether the New Trustee had a ‘claim’ in the Property given the Former Trustee had declaimed his interest.

While His Honour (“HH”) found that the making of a claim, not the vindication of that claim, was sufficient to satisfy this precondition, HH also found that the New Trustee did have an interest in the Property.

HH interpreted s133(9) as applying not only where an applicant is a person entitled to the property, but also where an applicant is a person in whom it seems to be just and equitable that the property should be vested. HH also made reference to the duty placed upon a Trustee, pursuant to Section 19(1)(f) of the Act, to take steps to recover property for the benefit of the Estate.

While HH, and the parties, were unable to identify any previous cases dealing with this particular issue, HH made reference to the decision of

Gleeson J In the matter of Vision Forklifts Pty Ltd (in liq) [2020] NSWSC 243 which dealt with the equivalent section of the Corporations Act 2001, section 586F(1).

After establishing the three precondition, HH made orders that it would be just and equitable for the Property to be vested in the New Trustee.

While the circumstance in this case are quite unique, this decision does open up a potential additional recovery option for trustees when property is disclaimed and a change in circumstances results in the property now having significant equity available.

Case Reference: Lucan (Trustee) v State of New South Wales, in the matter of the Bankrupt Estate of Williams [2022] FCA 751 (29 June 2022)

Predictions for insolvency appointments for FY2023

The last quarter has been a wild one for the Australian economy, with mounting headwinds from a range of international and domestic factors. While these factors have placed increasing pressure on businesses, they haven’t yet caused a significant increase in the number of insolvency appointments we are seeing.

The last quarter has been a wild one for the Australian economy, with mounting headwinds from a range of international and domestic factors. While these factors have placed increasing pressure on businesses, they haven’t yet caused a significant increase in the number of insolvency appointments we are seeing.

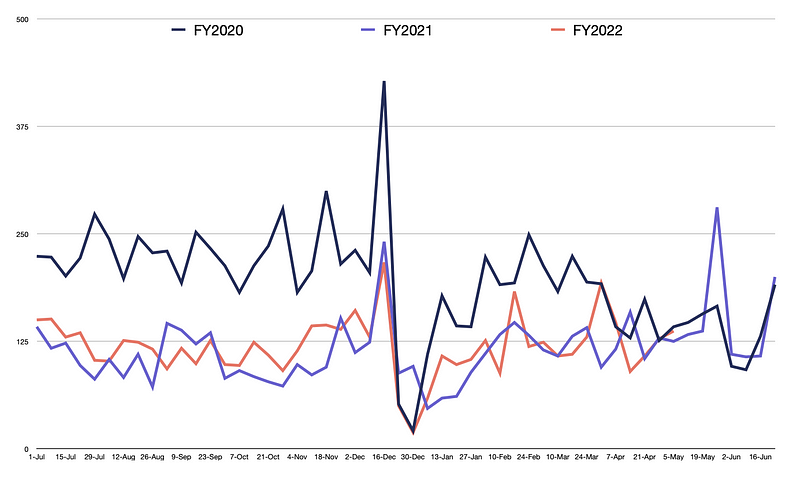

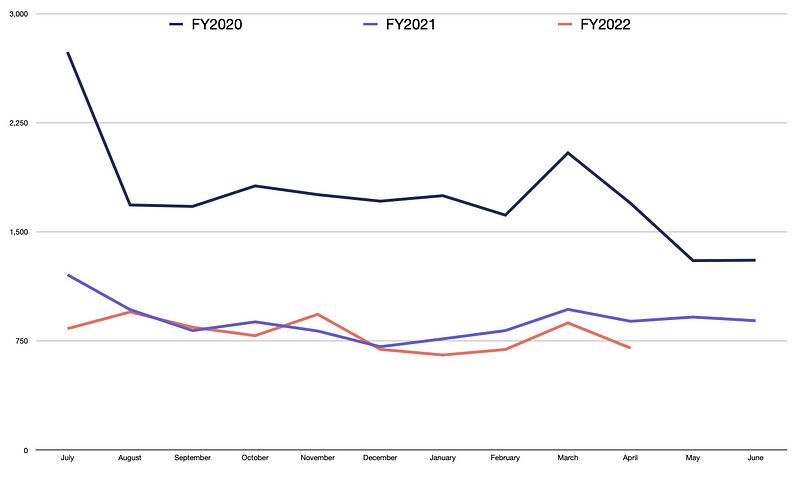

Corporate Insolvency

Corporate insolvency appointments in FY 2022 has tracked along at essentially the same rate as FY2021. In FY 2021, we saw total corporate insolvency appointments of 6,049, and while all the numbers aren’t in for FY2022 yet, I expect the final number will be around 6,500 appointments for the year. While that’s an increase of about 7% on last financial year, it is still a long way below the long run average of 10,744 appointments per financial year.[i]

Personal Insolvency

Personal insolvency appointments for FY2022 remained historically low. Running at about 40% of historical norms and continuing to fall in FY2022. For FY2021 there were 10,628 personal insolvency appointments, while we are likely to see in the order of 9,500 in FY2022 by the time all the numbers come in. This is a pretty surprising outcome. Despite the lifting of restrictions on enforcing debts and taking bankruptcy action, we have still seen personal insolvency numbers fall in FY2022. [ii]

The Economy

Despite the low insolvency appointment numbers in FY2022, the business and financial environment continues to deteriorate, with a number of factors likely to create big negative headwinds for the economy in FY2023.

These include:

- Inflation, which was at 5.1% last quarters and is expected to be over 7% by the end of 2022. The RBA has forecast that it will be several years before inflation falls back within their 2 to 3% target range. Continued high inflation will place constant pressure on business and household bottom lines.

- Interest rates are set to increase significantly as the RBA is committed to fighting inflation. We had already seen two increases in recent months and markets are predicting the cash rate to reach 3% by then end of 2022 and peak at 3.8% in mid-2023. For each 1% increase in the cash rate, Australian households see about a 5% decrease in disposable income, meaning less money in the economy to be spent in local businesses.

- Supply chain challenges will continue for the next 18 to 24 months. The cost of shipping goods from our major import markets to Australia remains almost 400% above the historical averages and shortages in transport capacity will keep prices elevated through all of FY2023. China, Australia’s largest trading partner, has given strong indications that lockdowns to support COVID-Zero will remain a core policy for at least the remainder of 2022. As a result, we will continue to see business experience difficult obtaining needed supplies from overseas.

- Staff shortages and increases in wages are already having a significant impact on a lot of industries and this trend will continue through FY2023. Unemployment remains at a near record low of 3.9%, while workforce participation is already at near record highs. One of the key drivers of staff shortages is the freeze on immigration that took place over the pandemic period. While that freeze has been lifted, immigrant workers have been slow to return to Australia and forecasts are that it will be some significant time until immigrations starts to have an impact on staff shortages.

- Energy prices remain very high, especially petrol prices as a result of both the Ukraine war and a global shortage in refining capacity. With global demand expected to remain high and the process to bring on additional capacity a long one, petrol prices will remain high in Australia for the foreseeable future. Australia also has a looming increase in the fuel excise in September this year which will put further upward pressure on petrol prices.

Insolvency Tsunami?

With all these challenges facing the Australian economy it’s only a matter of time until we start to see the impact on businesses and individuals convert into increasing insolvency appointment numbers. However, I don’t think we will see a tsunami. The most likely outcome is a slow increase in appointment numbers through FY2023, with appointment numbers peaking at around 120% of the historical averages in late 2023.

[i] Source: ASIC — Series 1B Notification of companies entering external administration and controller appointments — weekly.

[ii] Source: AFSA’s Monthly personal insolvency statistics 2020; 2021; 2022.

Make Sure the Price is Right

A recent case we saw highlighted an important factor that many businesses seem to be overlooking in the current environment, getting their pricing right.

A recent case we saw highlighted an important factor that many businesses seem to be overlooking in the current environment, getting their pricing right.

In this case, we had a business owner who was struggling. They were unable to get the staff they needed to properly services their customers and due to increases in some input costs, they were also losing money on the work they were doing. This was obviously creating a lot of stress, and they were looking for a solution that would get their business back on its feet. They were just looking in the wrong places, spending all their energy focusing on how to get more staff and trying to find places to cut costs, when the real solution lied with their pricing.

By increasing their price, they could bring their core service offering back to a healthy profit margin and while this was going to result in the loss of some business as the more cost conscious customers went elsewhere, they didn’t have the staff to service all of their customers anyway. This approach resolved both their key challenges, mitigating the need to hire more staff, and returning the business to profitability.

As input costs, interest rates and wages continue to rise, it is important for business to regularly review their pricing to make sure that they are both making money on what they sell, but also are maximising the profit they are making with the resources they have available. Getting pricing wrong can mean working too hard for little or no reward. Unfortunately, I’ve encountered more than a couple of business owners recently who had completely overlooked pulling there price level as part of their response to the current challenges.

Universal Distributing is no Silver Bullet

A recent case in the NSW Supreme Court gave a good remainder about the limitations of the Universal Distributing principle.

However, the Universal Distributing principle isn’t all encompassing and this case gives an example of when reliance upon it didn’t work out in the external administrator’s favour.

A recent case in the NSW Supreme Court gave a good remainder about the limitations of the Universal Distributing principle.

As a refresher, in Re Universal Distributing Co Ltd (in Liq) (1933) 48 CLR 171, the Court established the principle that an external administrator is entitled to recover costs and expenses related to the preservation and realisation of assets in priority to the interest of a secured creditor in those same assets, and that the external administrator has an equitable lien in respect of such costs and expenses over the assets.

This is obviously a principle that is very useful for external administrators and one that I have used on many occasions to ensure that we got paid for the work we did preserving and realising assets.

However, the Universal Distributing principle isn’t all encompassing and this case gives an example of when reliance upon it didn’t work out in the external administrator’s favour.

In this case, Administrators were appointed to two related entities, Atlas CTL and Pty Ltd (”Atlas”) and PJM Fleet Management Pty Limited (“PJM”). Atlas offered short-term car and truck rentals and leasing of vehicles to ride-share operators, while PJM leased vehicles from a variety of vehicle finance providers (such as Volkswagen, BMW, Nissan, and Toyota Finance) and provided these vehicles to Atlas for leasing. Each of the Finance Companies held purchase money security interests over the vehicles they financed, and Volkswagen and Nissan Finance held each also held a general security agreement with Atlas. It’s fair to say, everything of value was subject to at least one perfected security interest.

The Administrators decided to trade on the business of Atlas, with a view to selling the business as a going concern. However, following a sale campaign, no buyer was found, and the Administrators had accrued a significant trading loss.

At this point, the finance companies appointed receivers and mangers and tools steps to realise their secured property. After the sales were completed and the business of Atlas was shut down, the only significant pool of fund was approximately $5 million held by Volkswagen from the realisation of their secured property.

The Administrators then brought a claim that their remuneration and costs, totalling approximately $2.4 million, were secured by an equitable lien arising from the Universal Distribution principle. The application was made on the basis that the Administrators’ work to preserve and realise the assets of Atlas and PJM had been of benefit to Volkswagen Finance.

The Administrators submitted that an equitable lien would arise when:

* The external administrator acts reasonably.

* The administrator attempts to preserve, secure or realise assets.

* There is a sufficient nexus between the work done and the salvage objective.

* There is a fund (or assets) which may properly be the subject of the lien.

* That it would be unconscientious for the creditors who stand to take the benefit of the fund (or assets) to do so without recognising the administrator’s work.

The Administrator argued that it was reasonable for them to trade on the business with a view to a sale and that where the secured creditors adopted a ‘wait and see’ approach, it would be contrary to public policy to discourage Administrators from trading on businesses.

The Court dismissed the Administrator’s claim, finding that the claim failed both on the principle and on the facts.

The Universal Distributing principle only created an equitable lien over assets, or a pool of funds, if there was a sufficient nexus between the administrator’s activities and the preservation of assets or creation of the fund. In this case, the Court found that the Administrators did not have a role in preserving the assets or in the creation of the funds. In fact, rather than being directed to the preservation or realisation of the secured assets, the Administrators put them at risk by continuing to use them in the trading of the business.

This case gives a timely reminder that before deciding to trade on, and Administrator needs to be aware of both the costs associated with trading and how these will be funded. Further, when it is intended to rely upon the Universal Distributing principle, detailed records need to be retained as to both what work was done, and how that work was related to the preservation and realisation of specific secured property.

Tips for Construction Companies — How to Survive

Things are tough right now for companies in the construction sector. They’ve been hit by a raft of challenges all at once. Factors like the rising cost of building supplies, a shortage of skilled labour, and adverse weather conditions have all put pressure on construction businesses, making it harder to turn a profit. We’ve also seen some big contruction companies fail, which has flow-on effects on sub-contractors and suppliers in the industry.

Things are tough right now for companies in the construction sector. They’ve been hit by a raft of challenges all at once. Factors like the rising cost of building supplies, a shortage of skilled labour, and adverse weather conditions have all put pressure on construction businesses, making it harder to turn a profit. We’ve also seen some big contraction companies fail, which has flow-on effects on sub-contractors and suppliers in the industry.

In such a difficult trading environment companies in the construction sector need to be especially vigilant and take steps to protect themselves. Here are a few high-level tips to help companies in the sector survive and thrive.

Monitor Solvency

Anytime a company faces difficult trading conditions there should be a focus on monitoring solvency.

Trading whilst insolvent comes with significant commercial and criminal implications for Directors in Australia, so it’s vital for them to know where their company’s financial position is on a regular basis.

Practically, this means more regularly updating the books and reviewing the company’s financial position. Often directors are busy with the day-to-day and will only look at their financial position on a quarterly or even annual basis. In times of crisis, you need to step up the frequency of these reviews to avoid inadvertently trading whilst insolvent.

Collect your Debtors

With more failures likely in the construction industry, it’s important to keep debtors days low and make sure that there aren’t debtors outstanding long past due dates. This means monitoring debtors and then quickly moving to active enforcement when they become overdue.

I have seen many instances where sub-contractors will run up significant debts with a single client, often going 90 or 120 days or more without payment while continuing to do work, exposing themselves to significant risk when that debtor fails.

Monitor Input Costs and Consider Unprofitable Contracts

As cost pressure grows companies need to be constantly monitoring input prices and re-costing existing projects. As costs rise existing contacts may flip from profitable to losing money. Directors need to know when this happens so you can make an informed choice about what to do with those contracts. In tight times, construction companies need to be focusing on their most profitable contracts while considering renegotiating or abandoning unprofitable ones.

Future Proof New Contracts

Avoid entering into fixed-price contracts going forward. I’ve already seen several companies stuck with fixed price contracts that are now very unprofitable.

Negotiate new contracts with floating cost mechanisms to allow for changes in input costs in the future and include clauses around weather delays to better share the risk between the contract parties.

Ask for Help

Don’t be afraid to ask for help. Lean on your trusted advisors like your accountant and solicitor, they are experts in their areas and can help you manage risk and get your company through the tough times.

China’s Demographic Struggles

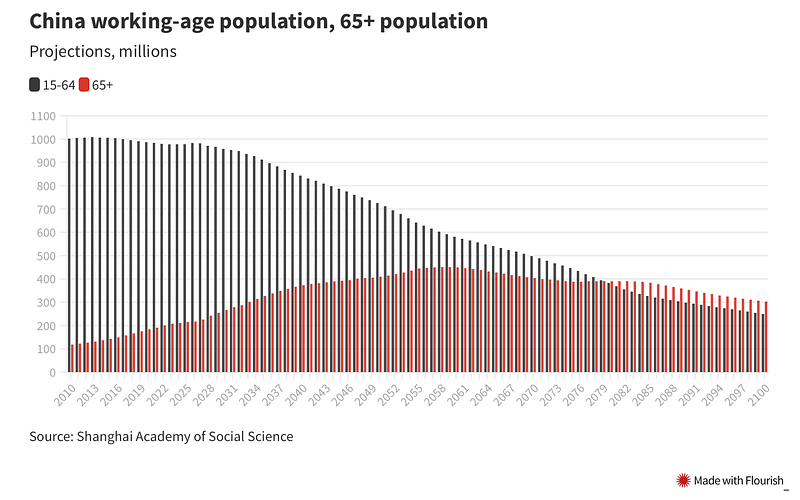

China’s population will begin to shrink for the first time this year and is expected to fall by almost a billion, to 587 million over the next 80 years.

Further, the China’s working age population peaked in 2014 and from 2079 there are expected to be more elderly people drawing benefits that people working.

Following on from Yesterday’s post about China’s current economic woes, lets look at a longer run challenge, their ageing population.

China’s population will begin to shrink for the first time this year and is expected to fall by almost a billion, to 587 million over the next 80 years.

Further, the China’s working age population peaked in 2014 and from 2079 there are expected to be more elderly people drawing benefits that people working.

This obviously has some dire consequences for China’s long term economic growth and sustainability.

China’s efforts to boost birth rates have thus far been ineffective, with fertility rates continuing to fall. Despite removing the one child policy and providing incentives for people to have children, the fertility rate was only 1.15 children per women last year, well below to the replacement rate of 2.1.

China has also eschewed immigration, the method that most western countries have used to maintain their working age populations as fertility rates fell. In 2017, the last year we have records, China only granted 1,576 permanent residency cards, by comparison, the USA issued over 1.2 million.

If China’s youth continue their aversion to children, I suspect at some point China will be forced into opening the immigration flood gates to keep their economy growing and sustainable.

China’s Economic Woes and the Impact on Australia

After recent economic data showed that both retail spending and industrial production contracted sharply in April, it looks likely that China will miss its annual growth targets this year and is at significant risk of slipping into a recession in late 2022 or early 2023. This would have dire consequences for the Australian economy. China remains our largest export market, consuming almost a third of all exports.

After recent economic data showed that both retail spending and industrial production contracted sharply in April, it looks likely that China will miss its annual growth targets this year and is at significant risk of slipping into a recession in late 2022 or early 2023. This would have dire consequences for the Australian economy. China remains our largest export market, consuming almost a third of all exports.

China’s Current Doldrums

China’s economic data for April was almost universally bad. Retail sales shrank 11.1% year on year (“YoY”), well in excess of the 6.1% markets had predicted. Industrial production also fell (by 2.9% YoY) and manufacturing also declined (by 4.6% YoY). A the same time residential construction starts also fell to 2011 levels. Unemployment is also rising, hitting 6.1% in April, with youth unemployment at a worrying 18.2%.

China has been in a slow economic slide since it introduce curbs on property developers about twelve months ago. But the recent economic doldrums experienced by China are largely a result of the lockdowns impacting major centres like Shanghai, Jiangsu, and Zhejiang. The impact of lockdowns in these cities is most obvious in the daily freight traffic metrics, with all three showing precipitous falls as lockdowns are introduced.

Longer-Term Outlook

China appears to be committed to its zero-COVID strategy for the foreseeable future. There are currently no indications that China is preparing to move to the COVID-normal strategy that many western nations have now adopted. Its booster rollout has been slow, with more than 100 million over 60s still not triple-jabbed, and China has strongly resisted importing and rolling out more effective mRNA vaccines from the West. China also recently backed out of hosting the lucrative Asia Cup tournament in June 2023, an indicator that it expects to remain isolated into next year.

With the highly infectious Omicron variant now circulating in China, it’s highly unlikely that the country will be successful in eliminating the virus. Accordingly, we are going to see a stop-start economy in China, as regions and cities are forced into various levels of rolling lockdown with each successive outbreak. This will continue to have a significant impact on growth and consumer confidence, while continued instability will see supply chains reorientate away from China.

What this means for Australia

The continuation of zero-COVID by China and the resulting economic woes and instability pose a significant threat to Australia’s economy.

A key example is iron ore. There are already signs that the Chinese market for iron ore (Australia’s biggest single export) is significantly overextended. While iron ore spot prices have been historically high during the post-pandemic period, this strength has been largely based on the prospect of significant Chinese Government investment in construction projects. However, these projects are not materialising and will be hard to implement while also pursuing zero-COVID. Current market conditions are unsustainable. While Chinese blast furnaces have been running at near full utilisation, domestic finished steel demand has remained low. Unless steel demand improves significantly, a retreat in iron ore prices is likely, with the associated impacts on Australia’s current account and tax revenue.

There are similar stories for other key Australian exports. Demand for coal and gas from China is likely to weaken as lockdowns reduce demand for energy. We saw a significant drop in energy demand in Shanghai during its extended lockdown and I expect a similar impact from future lockdowns.

With it looking increasingly likely that China will retain a zero-COVID policy until at least 2023, it will be important for Australia to seek out other markets for its exports. There is a significant opportunity for both coal to India and gas to Europe that we should be looking to exploit while working to repair our relationship with China so Australia remains a trade partner and can take maximum advantage when China eventually moves away from zero-COVID and their economy recovers.

The Court Makes Interesting Use of s90–15 of the IPS

The Federal Court has made innovative use of its powers under Section 90–15 of the Insolvency Practice Schedule (“IPS”) to amend various provisions around calling for and adjudicating on Proofs of Debt in Woodhouse (Liquidator), in the matter of Forex Capital Trading Pty Ltd (in liq) [2022] FCA 600.

The innovative approach was in response to a fairly unique set of circumstances. The Company in Liquidation was a seller of over-the-counter derivatives and the Liquidation was faced by approximate 8,600 clients with potential claims against the Company totalling approximately $69.5 million.

The Federal Court has made innovative use of its powers under Section 90–15 of the Insolvency Practice Schedule (“IPS”) to amend various provisions around calling for and adjudicating on Proofs of Debt in Woodhouse (Liquidator), in the matter of Forex Capital Trading Pty Ltd (in liq) [2022] FCA 600.

The innovative approach was in response to a fairly unique set of circumstances. The Company in Liquidation was a seller of over-the-counter derivatives and the Liquidation was faced by approximate 8,600 clients with potential claims against the Company totalling approximately $69.5 million.

The Company had been provided with a letter of comfort by its Ultimate Holding Company (“UHC”) whereby the UHC undertook that, upon request, it would provide financial support to meet any debts incurred by the Company. However, the undertaking was to be terminated on 30 June 2022. Accordingly, there was pressure on the Liquidators to urgently quantify the debts of the Company so that they could make a claim against the UHC before the undertaking expired.

The Liquidators approached the Court and sought Orders that would permit them to conduct an abridged process for the adjudication and admission of claims, that would allow “customers the option to accept a 15% discount on the value of their claims as calculated by the Liquidators by a certain deadline, in exchange for exempting them from providing further detailed evidence as to each element of their alleged claims.”

The expedited process would allow the Liquidators to quantify the Company’s debts and make a claim under the undertaking before it expired, maximising the potential return to creditors.

Given the obvious commercial logic behind the application, the Court sensibly made Orders, amending the process for calling for and adjudicating on proofs of debt set out in Corporations Regulations 5.6.48, 5.6.49, and 5.6.54. In particular, the Orders set out the form of the notices to be sent to creditors to satisfy the Liquidators’ obligations and the notices are well worth a read.

It’s great to see the Court sensibly utilise its powers under s90–15 of the IPS to assist Liquidators to maximise the likely outcome for creditors. It’s for situations like this one that these powers exist.

Link to the Judgement: https://www.judgments.fedcourt.gov.au/judgments/Judgments/fca/single/2022/2022fca0600

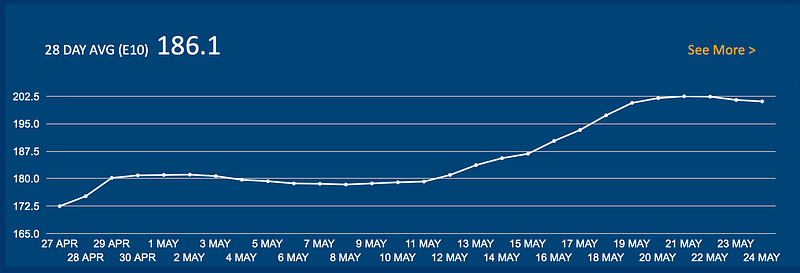

The Fuel Excise Cuts Didn’t Work

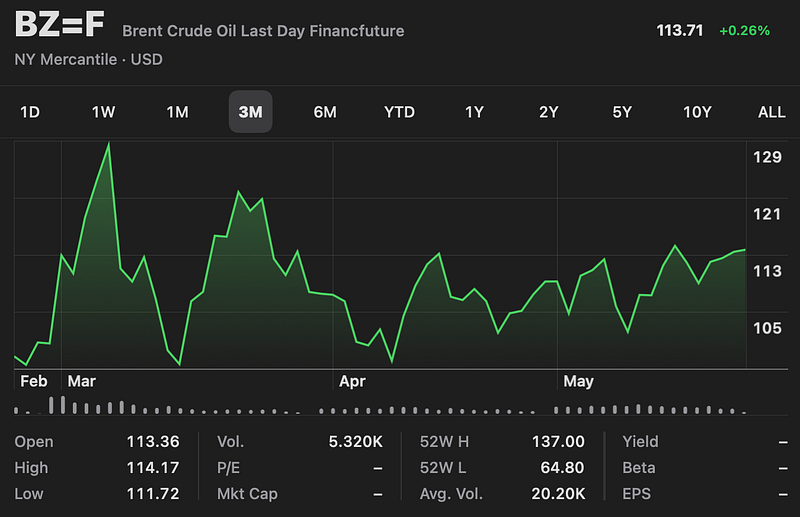

Just before the budget back in March , I posted that any cut to fuel excise would be pointless and would fail to provide any long term relief to consumers.

This week average petrol prices in Sydney were back over $2.00, exactly the same place they were before the fuel excise cut was announced on 29 March. The cut provided about six weeks of price relief before demand pushed prices right back to where they were before the government intervened.

Just before the budget back in March , I posted that any cut to fuel excise would be pointless and would fail to provide any long term relief to consumers.

This week average petrol prices in Sydney were back over $2.00, exactly the same place they were before the fuel excise cut was announced on 29 March. The cut provided about six weeks of price relief before demand pushed prices right back to where they were before the government intervened.

Markets operate in equilibrium, at a price where supply and demand are balanced. When fuel prices fell as a result of an external force (the fuel excise cut) they were out of equilibrium. As a result demand quickly exceeded supply in the current constrained market and prices just went back up until supply and demand were in balance again.

Over the same period we’ve seen almost no change in the price of oil. So all this policy has achieved is to transfer $3 billion of fuel excise from the government to petrol suppliers.

It was a terrible short-sighted policy from the start and should be unwound as soon as possible.

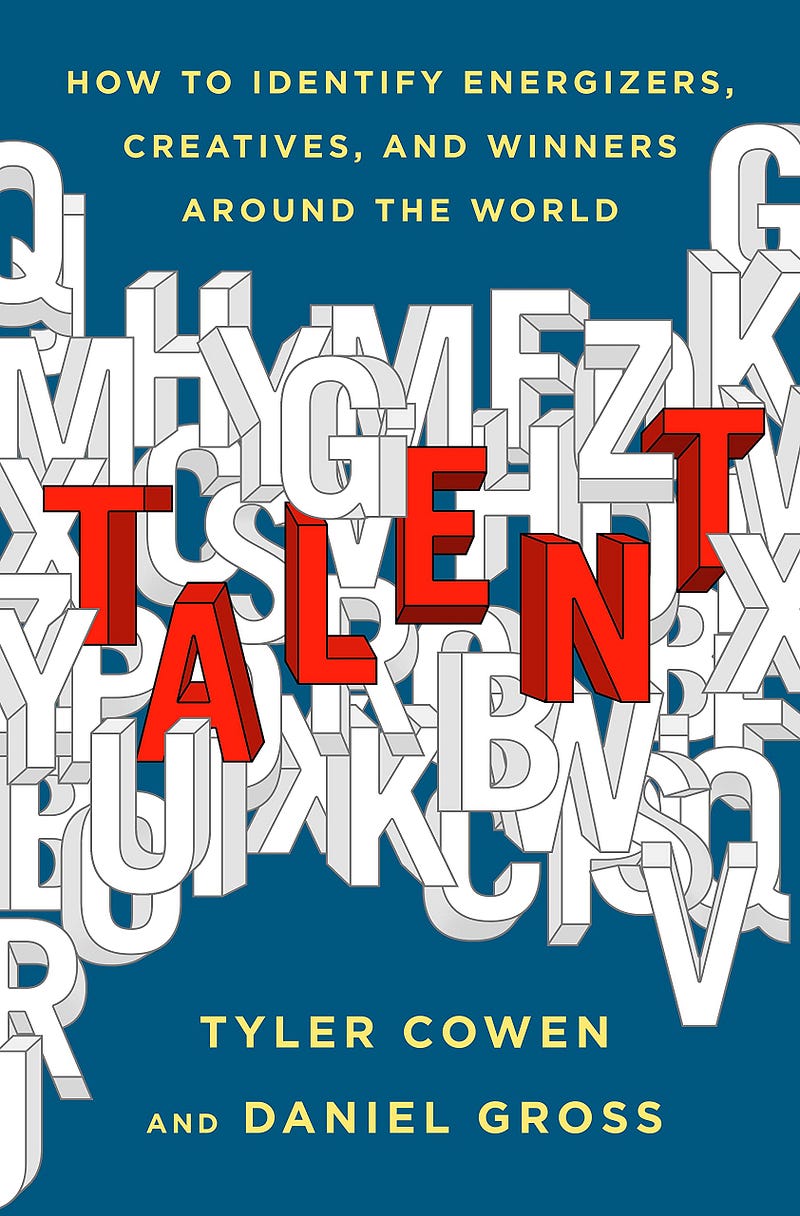

Talent: How to Identify Energizers, Creatives, and Winners Around the World

Talent is the result of a collaboration between economist Tyler Cowen and Venture Capitalist Daniel Gross and it reflects their careers with a focus on how they both go about finding talent in their respective careers. While a lot of the advice is still worthwhile for those hiring for their business, expect to be doing some selective application of the ideas in the book.

Talent provides some brilliant practical advice, with detailed ideas for running interviews, an interesting section on optimising interview questions with examples, and a timely guide to interviewing remote candidates.

Talent is the result of a collaboration between economist Tyler Cowen and Venture Capitalist Daniel Gross and it reflects their careers with a focus on how they both go about finding talent in their respective careers. While a lot of the advice is still worthwhile for those hiring for their business, expect to be doing some selective application of the ideas in the book.

Talent provides some brilliant practical advice, with detailed ideas for running interviews, an interesting section on optimising interview questions with examples, and a timely guide to interviewing remote candidates. I particularly liked one of the proposed interview questions “What are the open tabs on your browser right now?” as a clever way to get an insight into how a candidate uses their free time and what is interesting to them.

I was also particularly fond of the chapters on Disability, Women, and Minorities, which highlight the benefits that can accrue to an organisation through a more diverse workforce. They also provide practical tips on how you can modify your talent search and hiring process to better accommodate more diverse candidates. This is an area that is underexplored in other books I’ve read on this topic so I especially appreciated it here.

Unfortunately, Talent also strayed off into more philosophical territory that’s less valuable. In particular, it spent far too much time exploring the five-factor theory and its dubious benefits.

Talent is petty short and I appreciate that way it avoids lengthy diversions into stories and examples. These appear far too often in ‘advice’ style books and make the books longer than they need to be. It was a bit of a slug to read, with some dense sections that hammer on a point longer than I thought was necessary.

Overall Talent is a useful book that I would recommend to anyone involved in the hiring process or who has interested in improving their ability to spot talent. It’s a quick read and had more than enough valuable ideas to make it worthwhile.