Blog

Read my writing about Business, Insolvency, Turnaround, and the Economy.

Federal Reserve increases rates 75bp

Overnight the Fed raised rates in the USA by another 75bp to a target range of 3.75% to 4.00%. This was not a surprise, a fourth consecutive 75bp rise had been widely anticipated, as inflation indicators in the USA stubbornly refuses to roll over.

While there was some new wording in the Fed's statement, which hinted that we may be approaching a slow down in the hiking cycle, Powell made it very clear in his press conference, that it was far to early to be talking about a pause in the rate cycle.

“What I am trying to do is make sure our message is clear, which is that we think we have a ways to go, we have some ground to cover with interest rates, before we get to that level of interest rates that we think is sufficiently restrictive,” Powell said.

What this means is the Fed may slow the pace of rate increases going forward, but expects the terminal rate to be higher, and to be with us for longer, than previous forecasts.

For Australia this likely means more pressure on the Australian dollar as the Fed continues to raise rates faster than the RBA.

High resource prices, coupled with strong resource demand, have kept the AUD from falling too far during this hiking cycle. However, there are signs that some of that resource demand is coming off, and without that support, or a more hawkish turn from the RBA, I expect the AUD to slip further.

PPSR Reminder

I had a conversation with a business owner today that's, unfortunately, all to common.

This business wasn't registering their security interests (credit agreements) on the Personal Property Securities Register (PPSR). In fact they didn't even know what the PPSR was!

As a result they'd gotten badly burned when a client had gone into Liquidation, with a significant quantity of their stock that had not been paid for. If this business had a Purchase Money Security Interest (PMSI) registered, they would have had a good chance of getting all that stock back, but without the registration, they were out of luck and got lumped into with all the other unsecured creditors.

Despite the Personal Property Security Act commencing over a decade ago, I still regularly see businesses that do not have their securities properly documented and registered, often costing them large amounts of money.

So if you are chatting to any business owners over the pre-christmas period (especially if you're an advisor), maybe take a few minutes to check in and make sure they have all their security interests they may have properly documented and registered.

They'll thank you if something does go wrong!

RBA Increases rates 25bp

The RBA increased interest rates by another 25bp to 2.85% this afternoon, continuing along the cautious path they pivoted to last month, as was widely expected.

However, the bigger news was the revised inflation forecasts in the RBA's statement. The RBA now expects inflation to peak above 8% later this year, and stay above 4.75% in 2023, and won't fall below 3% at all in 2024. That is, inflation will be higher, for longer, and the RBA (bizarrely) doesn't seem to mind.

There really isn't a lot of sense to the RBA's approach. Higher inflation for longer is bad for the economy and households. The RBA could shorten this cycle by raising rates further and faster.

I'm still expect the RBA will have to raise the cash rate to around 4.20% to tame inflation and there is nothing to be gained getting there slowly and stretching out the period of excess inflation and the damage it causes to household incomes and balance sheets.

ATO Debt Book Explodes

The ATO's annual report for FY2022 is out and that means we get a look at jus show much debt the ATO has sitting on its books.

Over the pandemic period, when the ATO effectively stopped enforcing debts, unpaid tax ballooned from $26.5 billion at 30 June 2019 to $44.8 billion as at 30 June 2022. Small businesses are the largest segment, with collectable debts owing of $29.3 billion

While the ATO has tentatively restarted its 'firmer and stronger actions' debt recovery program, it's going to take a long time to work through the backlog.

Personal Insolvencies - September 2022

Personal insolvency numbers for September 2022 were released by AFSA this afternoon, and it's pretty much a repeat of the last two months.

In September there were 833 Personal Insolvencies, made up of:

🎃 501 Bankruptcies

🎃 317 Debt Agreements

🎃 10 Personal Insolvency Agreements

🎃 5 Deceased Estates

Personal insolvencies remained at near record lows for yet another month, mainly as the result of a super strong jobs market, low unemployment, and strong household balance sheets. Despite rising interest rates and rising cost of living, individuals aren't feeling the financial pinch quite yet.

There has also been a structural move in the personal debt collection market away from using bankruptcy as a recovery tool, with sequestration orders still down more than 50% from their pre-pandemic levels, despite moratoriums being lifted for over a year now.

Will bankruptcy numbers continue to stay this low? Almost certainly not, however the Australian economy, and especially Australian households, still have a lot of strength to withstand rate increases and a deteriorating global economy, so I don't expect to see any significant increase until at least Q2 2024.

September Quarter Inflation

An absolutely terrible CPI print today, with inflation way ahead of expectations in the September quarter.

🔥 Headline inflation was 7.3% YoY (vs 7.0% expected)

🔥 Trimmed mean inflation was 6.1% YoY (vs 5.6% expected)

🔥 The preliminary monthly core inflation print was up 6.8% YoY

🔥 Inflation for the September quarter was 1.8% QoQ

🔥 Non-discretionary inflation accelerates to 8.42% which will hit household budgets hard

🔥 Inflation is now broadly entrenched across the economy, with 83% of the basket increasing at more than 2.5% YoY

This is all pretty bad news for the economy, with inflation rising faster than expected. There's reasons for concern looking forward, with services inflation currently only making up 1.7% of the 7.3% YoY increase, there is a lot of scope for services inflation to grow (as we've seen in the US) and keep inflation high for an extended period.

While this print 'should' push the RBA to increase the pace of rate rises back up to 50bp a months, I suspect it won't and we'll see another 25bp move next week.

Instead, we are likely to see a longer and slower hiking cycle with a higher terminal rate around 4.2% late next year.

Budget Thoughts

A good solid budget by the government last night with nothing large or surprising. Which was exactly what was needed. A few quick observations:

✅ Great to see some fiscal responsibility after the wild excesses of the last government. Very little in the way of extra spending and banking most of the tax windfall from inflation and resources will make the RBA’s job battling inflation easier.

✅ Extra funding for tax enforcement and compliance is long overdue and fantastic to see. Unfortunately, opportunities for more substantive tax reform were passed over in this budget.

✅ Improvements to both childcare funding and paid parental leave are excellent and should be a tiny step in the direction of reducing genders based imbalances in the workforce.

✅ Not at all surprising given the parliament enquiry that is ongoing, but no changes announced in the budget for Australia's insolvency regime.

The framing of the budget was very much setting up for tax increases and spending cuts over the rest of Labour's term. While it's never nice to contemplate paying more tax, given the budget position Australia has, more tax revenue is going to be an unwelcome necessity.

On the positive side, this budget nicely balanced new spending with cuts in other areas. I'm hopeful this presages a similar approach in future budgets rather than a return to a tax and spend mentality.

Continued signs of strong inflation

A few more data points this morning that point towards inflation staying elevated and signalling that the RBA needs to do more with rate rises to slow the economy.

First, ANZ Research shows consumers spending continues to be well above trend, with no noticeable slowdown so far in 2022. I've previously highlighted the strong savings Australian households have, which will allow them to keep spending elevated long after interest rate increases start to bite (which the haven't yet). I expect we will be well into 2023 before we see a downturn in consumer spending on the current trajectory.

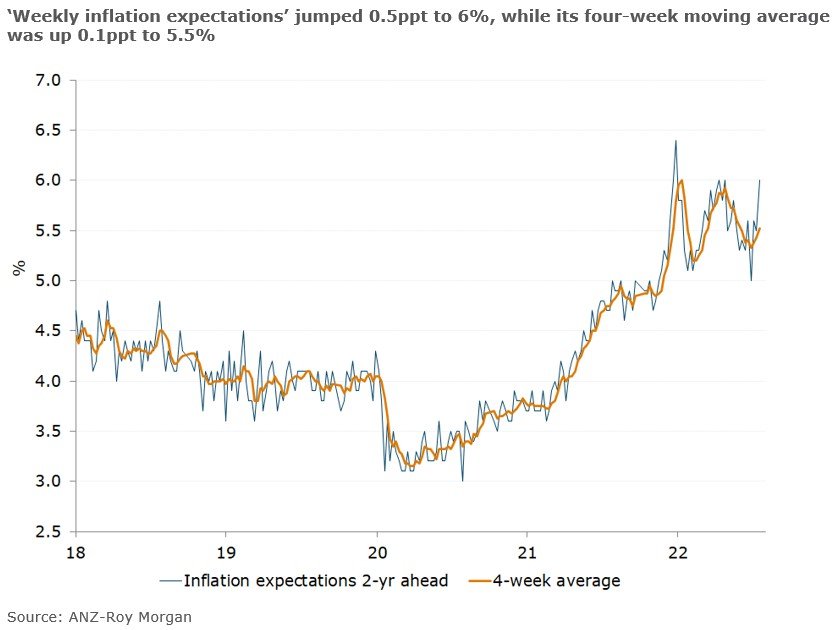

Second, inflation expectations (per ANZ-Roy Morgan) where up 0.5% to 6% in the wake of the RBA's dovish pivot. A clear demonstration of the risks associated with showing weakness and taking the foot of the gas when battling inflation. Higher inflation expectations tend to filter through as higher future inflation.

While the key data point for the RBA will be CPI figures out next week, it's looking increasingly likely that the 25bp increase this month was a mistake and an outsized 'catch-up' increase of 75bp will be the pragmatic move next month.

Putting housing price falls into perspective

Falls in real estate prices need to be put into perspective.

You can't open a news website at the moment without seeing endless hyperventilating about the 'crash' in real estate prices and you'd think, based on all the column inches dedicated to is, that falls in house prices were really important. But they have hardly any impact on most households or the real economy.

First, falls in asset prices only matter in real terms if the asset is sold and those falls in value are crystallised. As long as the asset stays in use and the 'loss' is never crystallised, the 'value' placed on the assets is irrelevant. Most real estate only gets sold VERY infrequently. The average time to hold real estate is over 12 years.

There are about 10.8 million houses in Australia. In an average year, only 500,000 of these houses actually get sold. When prices are falling the turnover rate also falls. Household aren't required to mark asset prices to market, and the incidence of forced sales by banks foreclosing in Australia is very low. So while the 'value' of a household's real estate may fall, the practical impact on most (95% or more) households in nothing.

Second, the vast majority of Australian properties are still well in the black. House prices have seen steady growth in value over the last several decades before the TFF fuelled boom in 2021. Only about 1.1 million houses have changed hands since January 2021. That means the more than 90% of properties were purchased at pre-2021 prices and we would need to see falls in value of more than 20% before any of these properties would actually be losing money if sold. More than 50% of properties have been held for more than 10 years, meaning they were bought at prices less than half of the peaks prices we saw in 2022.

The RBA blinks

Surprise move by the RBA this afternoon, increasing the cash rate by only 25 basis points to 2.60%. Well below the widely expected increase of 50 basis points.

This move is a huge mistake by the RBA. Now is not the time to show weakness and turn dovish. Inflation is still running far to hot. The monthly figures out last week showed no slowdown in core inflation, the labour market is still incredibly tight, and consumer spending has remained well above trend. Inflation expectation out this morning were up 0.6%!

There are no signs of inflation slowing and pulling back on the pace of interest rate rises will only send the wrong signal to the market and households, further stimulating inflation.

Finally the AUD has been under significant pressure the last week and needs further support. A doveish pivot by the RBA will do nothing to help the AUD maintain its value and a lower AUD means more imported inflation.