Blog

Read my writing about Business, Insolvency, Turnaround, and the Economy.

RBA Increases Cash Rate to 2.35%

The RBA took the widely expected option this afternoon and bumped the cash rate another 50 basis points to 2.35%.

The RBA's statements was along a similar theme to the last couple, but they did make the following interesting observation:

💰 They acknowledged the impact of domestic demand on inflation, in particular "There are widespread upward pressures on prices from strong demand, a tight labour market and capacity constraints in some sectors of the economy."

💰 The RBA still expected inflation to peak later this year and run above 4% for the whole of 2023. Inflation won't fall back inside the target band until 2024.

💰 The RBA notes wage growth has picked up and they expect the unemployment rate to decline further over the months ahead. They will be closely watching this impact this has on wage growth.

💰 The RBA acknowledged the continued strength in household spending as a source of uncertainty going forward. Particulary noting that "people are finding jobs, gaining more hours of work and receiving higher wages. Many households have also built up large financial buffers and the saving rate remains higher than it was before the pandemic."

💰 The RBA continues its commitment to taming inflation but didn't give much in the way of concrete forward guidance (maybe they've learned their lesson), stating "The Board expects to increase interest rates further over the months ahead, but it is not on a pre-set path. The size and timing of future interest rate increases will be guided by the incoming data and the Board's assessment of the outlook for inflation and the labour market."

Nothing particularly ground breaking here. The move of rates to 2.35% bring them in the range of what could be seen as neutral rates. However to bring down inflation we will need interest rates that are clearly restrictive. That means we likely have a few more increases to go before the RBA pauses and waits for the impact of raises to flow through the market.

Rates Will Need to Go Higher to Tame Inflation

The RBA will all but certainly be raising interest rates again this afternoon (by 50 basis points to 2.35%) and there have been various commentators suggesting that it's time for a pause in rate increases, or we are approaching the peak.

I don't think this is right, bond market expectations for peak rates have been pegged between 3.6% and 4.0% for months now and, there are strong indicators that the fight with inflation is far from done.

Let's run through a couple...

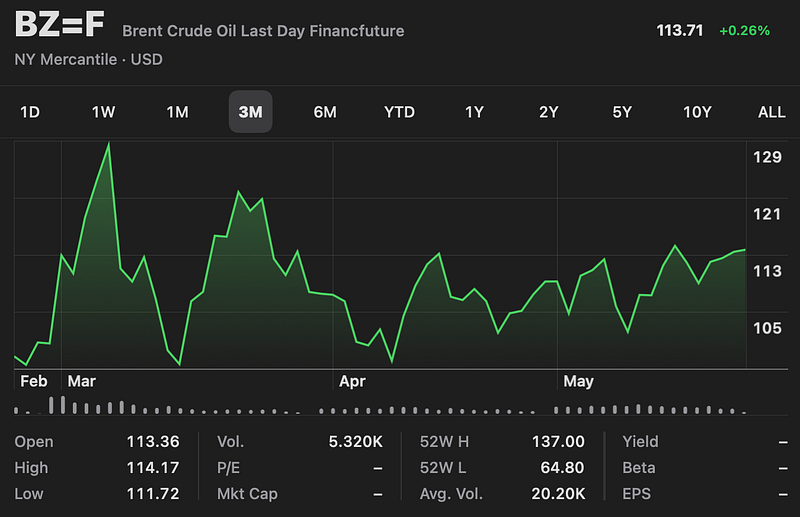

Petrol Prices are Going Back Up

Petrol prices have retreated somewhat from their highs in June, but petrol prices in Australia are set to go back up over the rest of 2022, for two reasons.

First, the Liberal’s vote grabbing petrol excise but will end on 28 September. Instantly adding 23 cents to the cost of a litre of petrol - this is good for a 0.25% jump in CPI all on its own.

Second, overnight OPEC+, the cartel of oil producing nations decided to cut oil production to boost prices. This cut will take a few weeks to work through the international trade system, but is worth a another 4 to 6 cents per litre by the time it gets to bowsers in a few weeks.

There isn't much hope of relief in 2023 either. Sooner or later China will have to abandon their pursuit of COVID-Zero and when they do, we will see a significant spike in demand for oil from China.

The Explosion in Rents Hasn’t Hit Inflation Yet

Australia’s rental crisis is no secret but the steep rises in rent are yet to flow through to official CPI numbers. Rents in major capital cities are up 19.5% YoY and are likely to go higher as over leveraged investors push up rent to cover for rising interest costs.

When the full rental rise flows through to inflation, it will account for another 1.2% increase in CPI all on its own.

Wages Growth is Slowly Picking Up

While wage growth remains well below inflation, there are signs that workers are starting to receive wage increases to catch up with inflation.

Wages across all industries were up 3.3% last quarter and NAB’s more recent business survey reported labour costs growing at 4.6% in July. While this is better news for workers, as it trims declines in real wages, it will also place continued upward pressure on inflation.

This is another trend that will not be going away anytime soon. With unemployment super low, and workplace participation near all time highs, there's going to be increased pressure on wages for the foreseeable future.

The USD is Dominant

The US dollar is currently at all time highs against other currencies and is due to climb higher, with the US Fed more aggressively raising rates than the rest of the developed world and capital continuing to move to the safe haven of the US dollar.

With so much of international trade denominated in US dollars, the continued weakening of the AUD against the USD will mean higher import prices and further inflation pressures in Australia.

Most Mortgage Holders are Immune to Rate Increases (For Now)

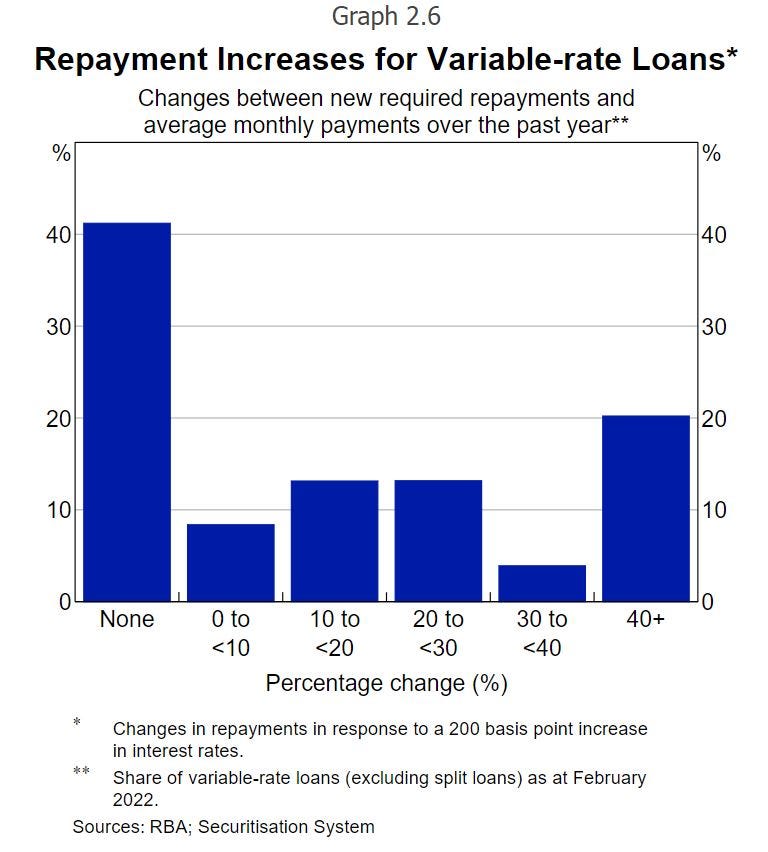

Most Australian mortgage holders just aren’t being impacted by rate increases yet. More than 40% of mortgages are fixed at ultra low rates and will remain there for almost two more years, while 35% of those on variable rates would seen no impact to their repayments from a cash rate at 3.35%, due to pre-payments, large offset accounts, or voluntary extra repayments.

With so much of the mortgage market effectively immune to interest rate increases until the cash rate gets to around 3.5% the RBA will be forced to go higher with interest rates to bring inflation under control. This is going to be very hard on the approximately 28% of variable rate mortgage holders who are very susceptible to rate increases.

A Quick Update on the Economy

There's been a bunch of interesting economic information out over the the last few days that gives us an interesting insight into how the economy is going and what to expect going forwards.

Here are a few of the most interesting tidbits, all in easy to digest chart form.

There's been a bunch of interesting economic information out over the the last few days that gives us an interesting insight into how the economy is going and what to expect going forwards.

Here are a few of the most interesting tidbits, all in easy to digest chart form.

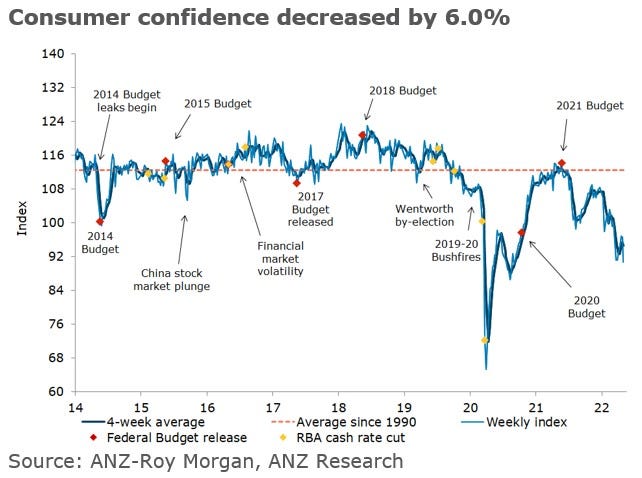

Consumer Confidence is Low

The ANZ-Roy Morgan Consumer Confidence index is at very low levels and saw another significant decline last week. It's clear that consumers are worried about the combined impact of cost of living pressures, real wage declines, and more expensive mortgages and these concern continues to push confidence lower.

Consumer Spending is Holding Up

Despite the decline in consumer confidence, households are continuing to spend. Observed spending, as tracked by ANZ Research, is still broadly on trend with no significant impact being felt from the RBA's rate rises or falling real wages. In particular, spending on large scale discretionary item such as furniture and travel continue to grow, while the majority of other discretionary spending remained stable.

Australians aren't yet turning to short term sources of credit to fund the continued resilience in consumer spending either, with credit card balances remaining relatively flat through all of 2022.

Business Confidence is Up

Despite the low level of consumer confidence, business confidence has remained generally positive and surveyed business conditions continued to be strongly positive. Clearly there is a disconnect between the way consumers and businesses see the economy at the moment, with a large chunk of that difference explained by the ongoing robustness in consumer spending. (Source NAB Business Survey)

Business Prices Are Exploding

Businesses are seeing increasing pressure on prices, across both purchase costs and labour. The growth in labour costs is not surprising as continued low unemployment and the economy rapidly approaching capacity limits was bound to put upward pressure on wages. It's interesting to note the disconnect between labour costs as survey by NAB and the Wage Price Index, with the WPI currently lagging NAB's survey by almost 9% on an annualised basis. This is likely to flow through to wage growth in the future and put more pressure on the RBA to keep up with rate increases. (Source NAB Business Survey)

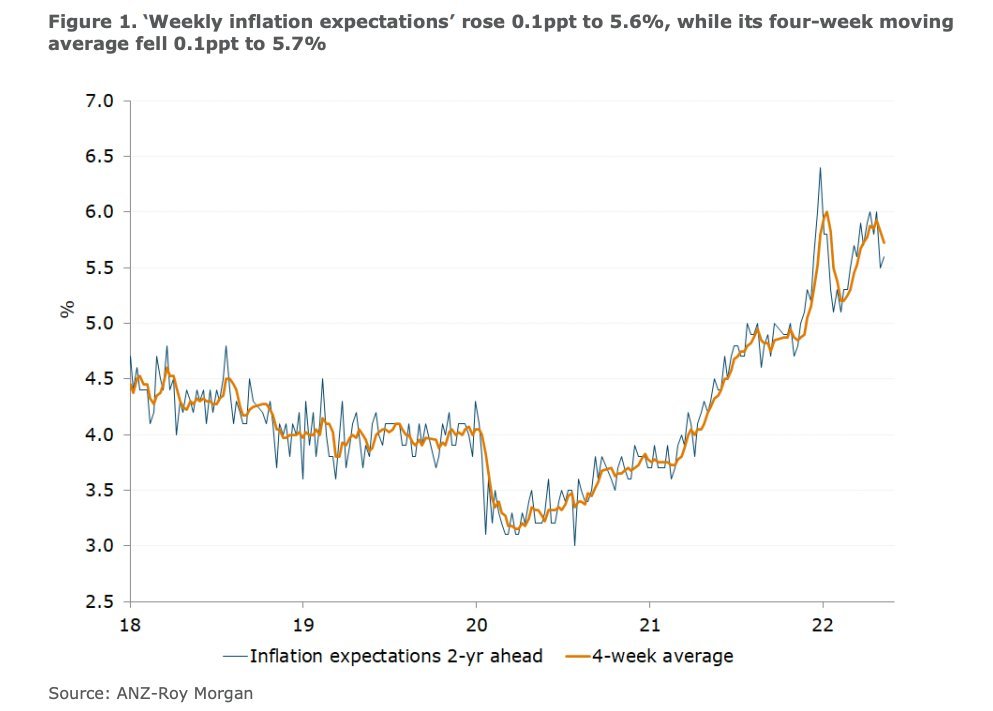

Inflation Expectations Could be Anchoring Higher

Inflation expects rebound in the last month to 5.6%. This means inflation expectations have now been anchored above 5.0% for almost a year, despite aggressive action from the RBA to tame inflation. This is going to be a significant concern for the RBA. The longer inflation expectations remain high, the more risk there is that expectations become anchored at these levels and we see lodger term inflation flow from pricing decisions and wage demands.

June Quarter Inflation

Australia’s quarterly inflation figures are out for the June quarter, and they aren’t quite as bad as expected. Don’t be fooled by this, they are still really bad.

⚠️ Headline inflation came in at 6.1% YoY, lower than the 6.3% estimate.

⚠️ Trimmed mean inflation (the RBA’s preferred measure) was ahead of estimated at 4.9%.

Australia’s quarterly inflation figures are out for the June quarter, and they aren’t quite as bad as expected. Don’t be fooled by this, they are still really bad.

⚠️ Headline inflation came in at 6.1% YoY, lower than the 6.3% estimate.

⚠️ Trimmed mean inflation (the RBA’s preferred measure) was ahead of estimated at 4.9%.

⚠️ 80% of the goods and services that comprise the CPI basket saw price rises of more than 2.5%.

⚠️ Inflation for non-discretionary items was at 7.9%, this is the stuff that hits households the hardest.

⚠️ The biggest contributors to inflation last quarter were housing construction, automotive fuel, and furniture.

⚠️ Despite the well documents rental crisis in NSW and VIC, the ABS still has rentals in both those states down YoY. This is likely due to data timing, and increased rents will hit inflation next quarter.

It’s clear that inflation is becoming more broad based and entrenched. The RBA needs to hit the issue on the head with more aggressive rate rises.

Australia has erased over a decade of wage growth in just the last 18 months.

This quarter’s inflation print pushes real wages down to the same level they were in December 2011. This will have devastating long-term effects on employees in Australia. It will take years for real wages to recover the ground they have lost and undo the damage that this short inflation spike has already wrought.

This is one of the many reasons why arguments that the RBA should go slow on rate increases and let inflation run to reduce the risk of a recession are so wrong-headed. Inflation has debilitating long-term effect on the prosperity and stability of a country.

I’d like to see something between 75 and 100 basis points next week.

The RBA Review Should Consider Nominal GDP Targeting

The government has released the terms of reference for the independent review of the RBA. They are pretty comprehensive.

The government appears very committed to inflation targeting, and this is the ‘default’ approach across most of the developed world. However, I hope the review board consider other options, like Nominal GDP Targeting (NGDPT).

The government has released the terms of reference for the independent review of the RBA. They are pretty comprehensive, covering:

- The RBA’s objectives, as outlined in the Reserve Bank Act (1959) and in the Statement on the Conduct of Monetary Policy, including the continued appropriateness of the inflation targeting framework.

- The interaction of monetary policy with fiscal and macroprudential policy, including during crises and when monetary policy space is limited.

- Its performance in meeting its objectives, including its choice of policy tools, policy implementation, policy communication, and how trade‑offs between different objectives have been managed.

- Its governance (including Board structure, experiences and expertise, composition and the appointments process) and accountability arrangements.

- Its culture, management and recruitment processes.

I’m very happy to see the review will specifically be looking into the appropriateness of the RBA’s inflation targeting framework.

The government appears very committed to inflation targeting, and this is the ‘default’ approach across most of the developed world. However, I hope the review board consider other options, like Nominal GDP Targeting (NGDPT).

NGDPT offers several advantages over inflation rate targeting that make it a superior tool for central banks:

- Targets price levels rather than the rate of change in price levels.

- Increases the relative importance of output or employment in the economy when setting monetary policy.

- It responds to shocks in both aggregate demand and aggregate supply.

- It encourages sounds fiscal policy and discourages unsound policy by offsetting changes in fiscal policy.

- It dispenses with the zero-lower-bound and makes negative rates more palatable.

NGDPT would deal with several of the terms of reference for the review. In models, NGDPT would have dealt better with the recent shocks to the economy (like the GFC and COVID) than inflation targeting did.

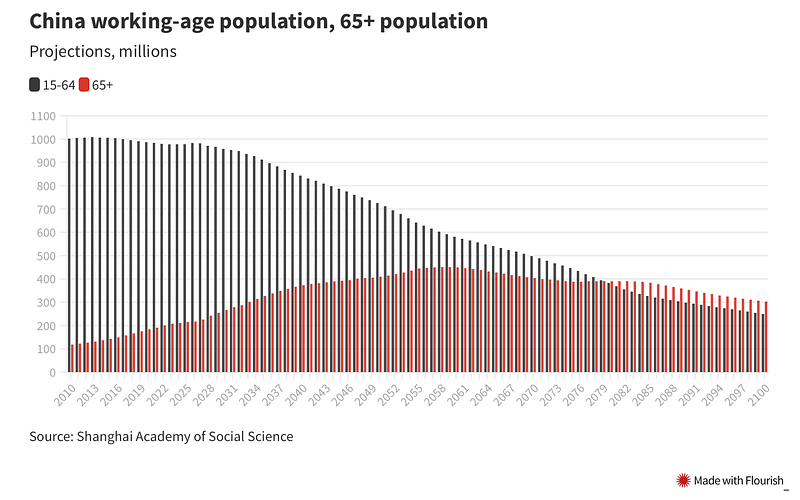

China’s Demographic Struggles

China’s population will begin to shrink for the first time this year and is expected to fall by almost a billion, to 587 million over the next 80 years.

Further, the China’s working age population peaked in 2014 and from 2079 there are expected to be more elderly people drawing benefits that people working.

Following on from Yesterday’s post about China’s current economic woes, lets look at a longer run challenge, their ageing population.

China’s population will begin to shrink for the first time this year and is expected to fall by almost a billion, to 587 million over the next 80 years.

Further, the China’s working age population peaked in 2014 and from 2079 there are expected to be more elderly people drawing benefits that people working.

This obviously has some dire consequences for China’s long term economic growth and sustainability.

China’s efforts to boost birth rates have thus far been ineffective, with fertility rates continuing to fall. Despite removing the one child policy and providing incentives for people to have children, the fertility rate was only 1.15 children per women last year, well below to the replacement rate of 2.1.

China has also eschewed immigration, the method that most western countries have used to maintain their working age populations as fertility rates fell. In 2017, the last year we have records, China only granted 1,576 permanent residency cards, by comparison, the USA issued over 1.2 million.

If China’s youth continue their aversion to children, I suspect at some point China will be forced into opening the immigration flood gates to keep their economy growing and sustainable.

China’s Economic Woes and the Impact on Australia

After recent economic data showed that both retail spending and industrial production contracted sharply in April, it looks likely that China will miss its annual growth targets this year and is at significant risk of slipping into a recession in late 2022 or early 2023. This would have dire consequences for the Australian economy. China remains our largest export market, consuming almost a third of all exports.

After recent economic data showed that both retail spending and industrial production contracted sharply in April, it looks likely that China will miss its annual growth targets this year and is at significant risk of slipping into a recession in late 2022 or early 2023. This would have dire consequences for the Australian economy. China remains our largest export market, consuming almost a third of all exports.

China’s Current Doldrums

China’s economic data for April was almost universally bad. Retail sales shrank 11.1% year on year (“YoY”), well in excess of the 6.1% markets had predicted. Industrial production also fell (by 2.9% YoY) and manufacturing also declined (by 4.6% YoY). A the same time residential construction starts also fell to 2011 levels. Unemployment is also rising, hitting 6.1% in April, with youth unemployment at a worrying 18.2%.

China has been in a slow economic slide since it introduce curbs on property developers about twelve months ago. But the recent economic doldrums experienced by China are largely a result of the lockdowns impacting major centres like Shanghai, Jiangsu, and Zhejiang. The impact of lockdowns in these cities is most obvious in the daily freight traffic metrics, with all three showing precipitous falls as lockdowns are introduced.

Longer-Term Outlook

China appears to be committed to its zero-COVID strategy for the foreseeable future. There are currently no indications that China is preparing to move to the COVID-normal strategy that many western nations have now adopted. Its booster rollout has been slow, with more than 100 million over 60s still not triple-jabbed, and China has strongly resisted importing and rolling out more effective mRNA vaccines from the West. China also recently backed out of hosting the lucrative Asia Cup tournament in June 2023, an indicator that it expects to remain isolated into next year.

With the highly infectious Omicron variant now circulating in China, it’s highly unlikely that the country will be successful in eliminating the virus. Accordingly, we are going to see a stop-start economy in China, as regions and cities are forced into various levels of rolling lockdown with each successive outbreak. This will continue to have a significant impact on growth and consumer confidence, while continued instability will see supply chains reorientate away from China.

What this means for Australia

The continuation of zero-COVID by China and the resulting economic woes and instability pose a significant threat to Australia’s economy.

A key example is iron ore. There are already signs that the Chinese market for iron ore (Australia’s biggest single export) is significantly overextended. While iron ore spot prices have been historically high during the post-pandemic period, this strength has been largely based on the prospect of significant Chinese Government investment in construction projects. However, these projects are not materialising and will be hard to implement while also pursuing zero-COVID. Current market conditions are unsustainable. While Chinese blast furnaces have been running at near full utilisation, domestic finished steel demand has remained low. Unless steel demand improves significantly, a retreat in iron ore prices is likely, with the associated impacts on Australia’s current account and tax revenue.

There are similar stories for other key Australian exports. Demand for coal and gas from China is likely to weaken as lockdowns reduce demand for energy. We saw a significant drop in energy demand in Shanghai during its extended lockdown and I expect a similar impact from future lockdowns.

With it looking increasingly likely that China will retain a zero-COVID policy until at least 2023, it will be important for Australia to seek out other markets for its exports. There is a significant opportunity for both coal to India and gas to Europe that we should be looking to exploit while working to repair our relationship with China so Australia remains a trade partner and can take maximum advantage when China eventually moves away from zero-COVID and their economy recovers.

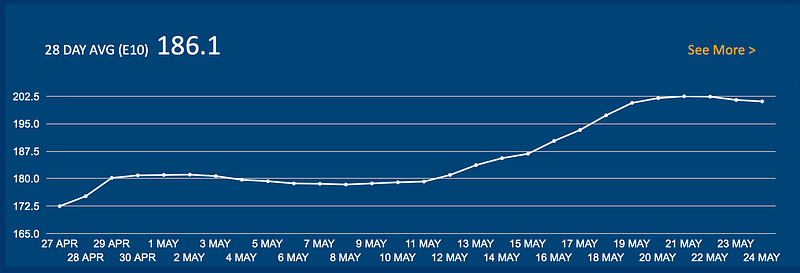

The Fuel Excise Cuts Didn’t Work

Just before the budget back in March , I posted that any cut to fuel excise would be pointless and would fail to provide any long term relief to consumers.

This week average petrol prices in Sydney were back over $2.00, exactly the same place they were before the fuel excise cut was announced on 29 March. The cut provided about six weeks of price relief before demand pushed prices right back to where they were before the government intervened.

Just before the budget back in March , I posted that any cut to fuel excise would be pointless and would fail to provide any long term relief to consumers.

This week average petrol prices in Sydney were back over $2.00, exactly the same place they were before the fuel excise cut was announced on 29 March. The cut provided about six weeks of price relief before demand pushed prices right back to where they were before the government intervened.

Markets operate in equilibrium, at a price where supply and demand are balanced. When fuel prices fell as a result of an external force (the fuel excise cut) they were out of equilibrium. As a result demand quickly exceeded supply in the current constrained market and prices just went back up until supply and demand were in balance again.

Over the same period we’ve seen almost no change in the price of oil. So all this policy has achieved is to transfer $3 billion of fuel excise from the government to petrol suppliers.

It was a terrible short-sighted policy from the start and should be unwound as soon as possible.

A few takeaways from yesterday’s interest rate decision by the RBA

As well as bumping rates, the RBA made a huge revision to their forecasts, with the central forecast now predicting headline inflation of around 6.00% and underlying inflation of around 4.75% by the end of 2022 before a steady decline.

- As well as bumping rates, the RBA made a huge revision to their forecasts, with the central forecast now predicting headline inflation of around 6.00% and underlying inflation of around 4.75% by the end of 2022 before a steady decline. Their previous forecast was 2.75% made in February this year. This new forecast is also a long way from the government’s forecasts that underlined the budget last month. It’s somewhat concerning that both treasury and the RBA got it so wrong only a couple of months ago.

- Lowe made some interesting comments in his press conference after the decision: “It’s not unreasonable to expect that interest rates could rise to 2.5%”. He followed up with “How quickly we get there and if we do get there will be determined by how events unfold. We have an open mind, over the past two years we have been very flexible, it changed in response to changing circumstances and we will continue to do that… a more normal level. How fast we will get there will be determined by events.”

- The RBA’s inflation forecast seems wildly optimistic to me and I suspect rates at 2.5% won’t be enough to get inflation fully under control. Neutral interest rates in Australia are likely in the 2% to 2.5% range at the moment, meaning the RBA still has a long way to go to get to a deflationary setting and both political parties have clearly indicated that they will be pursuing expansionary fiscal policy for the foreseeable future. However, it is nice to see the RBA move to a more flexible setting. The concrete statements about future interest rates made over the last 12 months really didn’t work out for them.

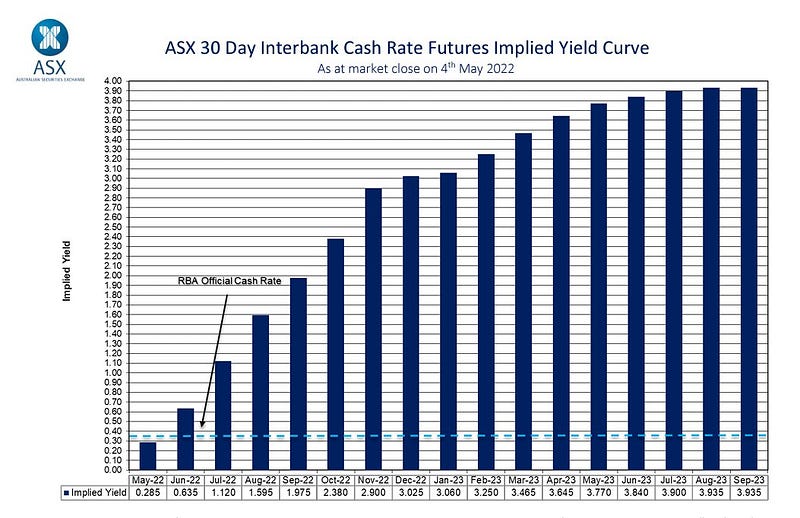

- The market seems to agree that the RBA is still being too conservative, pricing in much higher rates than Mr Lowe has contemplated. At the moment the market is pricing in a cash rate of almost 4% in February 2024.

- It looks like Australian’s with mortgages have smartly moved to protect themselves from rate rises. This will mean rates will have to go higher for longer to get the desired effect on demand. Per the ABS, more than 40% of households with mortgages would see not change to their repayments were rates to increase by 200 basis points.

- Inflation fears and concerns about rate rises and costs of living were already starting to way heavily on consumer confidence before today’s rate decision. Overall confidence was down 6%, with confidence dropping 9.6% amongst people ‘paying off their home loan’, while for people who already own their home or are renting confidence dropped by 4.7% and 4.2% respectively. Will be interesting to see how the rate rise impacts confidence

Inflation has gotten out of control while the RBA has been asleep at the wheel

Australia’s consumer prices were up 5.1% in the March quarter of 2022. Quite a bit more than the RBA was predicting and above the estimates of almost all the experts. While the headline number is shocking, its the highest it’s been in 20 years, reality is even worse.

The March quarter figures sill bake in couple of quarters effected by reduced activity as a result of COVID-19 lockdowns. If we normalise those quarters we get an eye watering annualise inflation rate of 8.67% to March 2022.

Australia’s consumer prices were up 5.1% in the March quarter of 2022. Quite a bit more than the RBA was predicting and above the estimates of almost all the experts. While the headline number is shocking, its the highest it’s been in 20 years, reality is even worse.

The March quarter figures sill bake in couple of quarters effected by reduced activity as a result of COVID-19 lockdowns. If we normalise those quarters we get an eye watering annualise inflation rate of 8.67% to March 2022.

A couple of takeaways…

First, there has been a lot of talk about the current bout of inflation being due to external factors like supply chain crunches, wars, and general global dislocation due to COVID. This line of reasoning is wrong. 100% of excessive inflation is due to bad monetary policy. Always! This is true for every respectable theory of economics (be it Keynesian, Austrian, monetarist etc).

It’s the RBA’s job to keep inflation under control. It’s been obvious for at least eighteen months that the unprecedented stimulus provided by the Australian Government would lead to growth in nominal spending once lockdowns ended and people could go out and spend all the money they had been saving while stuck in lockdown. Supply side issues just exacerbated the demand side issues, and when wages finally start playing catch up, inflation is only going to go higher. The RBA missed the boat by not normalising interest rates early to avoid an inflation blowout.

Second, the RBA has to raise rates at their meeting next week. A cash rate of 0.1% is clearly no longer appropriate for our economy. The market is expecting an increase, with a rate rise to 0.25% fully priced in and a 25% chance of an increase straight to 0.5%. If the RBA decides to sit on their hand yet again, they will lose all credibility.

I personally hope we see a strong move by the RBA, directly to 0.5%. Managing inflation is as much about the message that the RBA gives to the market than the actual interest rate moves it makes, and a large move so closely linked to the release of inflation data will send a strong message that the RBA is serious about controlling inflation this cycle.