Blog

Read my writing about Business, Insolvency, Turnaround, and the Economy.

The UK’s Energy Plan is Maddness

Britain's new energy plan is nuts.

For those who haven't heard, the British government plans to cap the price of energy for household for the next two years.

This will expose the British Government to essentially unlimited liability. The total cost of the program is estimated at over £140 billion. This is equivalent to almost 5% of Great Britain's GPD, and the whole amount will be borrowed.

They'd be far better off spending the money addressing the long term problem and transitioning to alternative energy sources.

The price cap will also make the energy crisis worse. High prices provide important signals to consumers to curb spending and seek alternatives. Prolonged high prices also provide important signals to capital markets that it's viable to invest in developing alternatives.

By putting in place this price cap, the British Government is wasting public money to make the energy crisis worse. A little like our government did, on a much smaller scale, but reducing the excise on petrol.

RBA Increases Cash Rate to 2.35%

The RBA took the widely expected option this afternoon and bumped the cash rate another 50 basis points to 2.35%.

The RBA's statements was along a similar theme to the last couple, but they did make the following interesting observation:

💰 They acknowledged the impact of domestic demand on inflation, in particular "There are widespread upward pressures on prices from strong demand, a tight labour market and capacity constraints in some sectors of the economy."

💰 The RBA still expected inflation to peak later this year and run above 4% for the whole of 2023. Inflation won't fall back inside the target band until 2024.

💰 The RBA notes wage growth has picked up and they expect the unemployment rate to decline further over the months ahead. They will be closely watching this impact this has on wage growth.

💰 The RBA acknowledged the continued strength in household spending as a source of uncertainty going forward. Particulary noting that "people are finding jobs, gaining more hours of work and receiving higher wages. Many households have also built up large financial buffers and the saving rate remains higher than it was before the pandemic."

💰 The RBA continues its commitment to taming inflation but didn't give much in the way of concrete forward guidance (maybe they've learned their lesson), stating "The Board expects to increase interest rates further over the months ahead, but it is not on a pre-set path. The size and timing of future interest rate increases will be guided by the incoming data and the Board's assessment of the outlook for inflation and the labour market."

Nothing particularly ground breaking here. The move of rates to 2.35% bring them in the range of what could be seen as neutral rates. However to bring down inflation we will need interest rates that are clearly restrictive. That means we likely have a few more increases to go before the RBA pauses and waits for the impact of raises to flow through the market.

Rates Will Need to Go Higher to Tame Inflation

The RBA will all but certainly be raising interest rates again this afternoon (by 50 basis points to 2.35%) and there have been various commentators suggesting that it's time for a pause in rate increases, or we are approaching the peak.

I don't think this is right, bond market expectations for peak rates have been pegged between 3.6% and 4.0% for months now and, there are strong indicators that the fight with inflation is far from done.

Let's run through a couple...

Petrol Prices are Going Back Up

Petrol prices have retreated somewhat from their highs in June, but petrol prices in Australia are set to go back up over the rest of 2022, for two reasons.

First, the Liberal’s vote grabbing petrol excise but will end on 28 September. Instantly adding 23 cents to the cost of a litre of petrol - this is good for a 0.25% jump in CPI all on its own.

Second, overnight OPEC+, the cartel of oil producing nations decided to cut oil production to boost prices. This cut will take a few weeks to work through the international trade system, but is worth a another 4 to 6 cents per litre by the time it gets to bowsers in a few weeks.

There isn't much hope of relief in 2023 either. Sooner or later China will have to abandon their pursuit of COVID-Zero and when they do, we will see a significant spike in demand for oil from China.

The Explosion in Rents Hasn’t Hit Inflation Yet

Australia’s rental crisis is no secret but the steep rises in rent are yet to flow through to official CPI numbers. Rents in major capital cities are up 19.5% YoY and are likely to go higher as over leveraged investors push up rent to cover for rising interest costs.

When the full rental rise flows through to inflation, it will account for another 1.2% increase in CPI all on its own.

Wages Growth is Slowly Picking Up

While wage growth remains well below inflation, there are signs that workers are starting to receive wage increases to catch up with inflation.

Wages across all industries were up 3.3% last quarter and NAB’s more recent business survey reported labour costs growing at 4.6% in July. While this is better news for workers, as it trims declines in real wages, it will also place continued upward pressure on inflation.

This is another trend that will not be going away anytime soon. With unemployment super low, and workplace participation near all time highs, there's going to be increased pressure on wages for the foreseeable future.

The USD is Dominant

The US dollar is currently at all time highs against other currencies and is due to climb higher, with the US Fed more aggressively raising rates than the rest of the developed world and capital continuing to move to the safe haven of the US dollar.

With so much of international trade denominated in US dollars, the continued weakening of the AUD against the USD will mean higher import prices and further inflation pressures in Australia.

Most Mortgage Holders are Immune to Rate Increases (For Now)

Most Australian mortgage holders just aren’t being impacted by rate increases yet. More than 40% of mortgages are fixed at ultra low rates and will remain there for almost two more years, while 35% of those on variable rates would seen no impact to their repayments from a cash rate at 3.35%, due to pre-payments, large offset accounts, or voluntary extra repayments.

With so much of the mortgage market effectively immune to interest rate increases until the cash rate gets to around 3.5% the RBA will be forced to go higher with interest rates to bring inflation under control. This is going to be very hard on the approximately 28% of variable rate mortgage holders who are very susceptible to rate increases.

Corporate Insolvency Market Report

Insolvency Australia have another excellent report out overnight summarising the corporate insolvency market for FY2021-22.

It's great to see Worrells still on top as the most appointed corporate insolvency firm in Australian last year 🥳

It's also interesting to see how many appointments from outside NSW are being taken by NSW based appointees. ASIC stats record 1,830 NSW based companies entering external administration last financial year, while Insolvency Australia's report shows NSW based appointees accepting 2,819 appointments.

You can download the full report here.

Personal Insolvency Stats - July 2022

AFSA have released personal insolvency figures for July 2022 and they were surprisingly low.

There were 692 personal insolvencies in July, down 17% YoY and 19% from June 2022.

The appointments broke down as follows:

🔵 410 Bankruptcies

🔵 274 Debt Agreements

🔵 8 Personal insolvency Agreements

162 (or 23%) of all personal insolvencies were business related, however, it's worth noting that 33.7% of Bankruptcies were business related, which is historically fairly high.

Despite the resurgence in corporate insolvencies in July 2022, personal insolvency not only remains at historic lows, but fell back to near-all-time lows.

I suspect that personal insolvencies will remain depressed for quite some time. While the ATO has started to pursue corporate debt, and other creditors have started to follow their lead, the same pressure just isn't being applied to individuals as yet.

A Quick Update on the Economy

There's been a bunch of interesting economic information out over the the last few days that gives us an interesting insight into how the economy is going and what to expect going forwards.

Here are a few of the most interesting tidbits, all in easy to digest chart form.

There's been a bunch of interesting economic information out over the the last few days that gives us an interesting insight into how the economy is going and what to expect going forwards.

Here are a few of the most interesting tidbits, all in easy to digest chart form.

Consumer Confidence is Low

The ANZ-Roy Morgan Consumer Confidence index is at very low levels and saw another significant decline last week. It's clear that consumers are worried about the combined impact of cost of living pressures, real wage declines, and more expensive mortgages and these concern continues to push confidence lower.

Consumer Spending is Holding Up

Despite the decline in consumer confidence, households are continuing to spend. Observed spending, as tracked by ANZ Research, is still broadly on trend with no significant impact being felt from the RBA's rate rises or falling real wages. In particular, spending on large scale discretionary item such as furniture and travel continue to grow, while the majority of other discretionary spending remained stable.

Australians aren't yet turning to short term sources of credit to fund the continued resilience in consumer spending either, with credit card balances remaining relatively flat through all of 2022.

Business Confidence is Up

Despite the low level of consumer confidence, business confidence has remained generally positive and surveyed business conditions continued to be strongly positive. Clearly there is a disconnect between the way consumers and businesses see the economy at the moment, with a large chunk of that difference explained by the ongoing robustness in consumer spending. (Source NAB Business Survey)

Business Prices Are Exploding

Businesses are seeing increasing pressure on prices, across both purchase costs and labour. The growth in labour costs is not surprising as continued low unemployment and the economy rapidly approaching capacity limits was bound to put upward pressure on wages. It's interesting to note the disconnect between labour costs as survey by NAB and the Wage Price Index, with the WPI currently lagging NAB's survey by almost 9% on an annualised basis. This is likely to flow through to wage growth in the future and put more pressure on the RBA to keep up with rate increases. (Source NAB Business Survey)

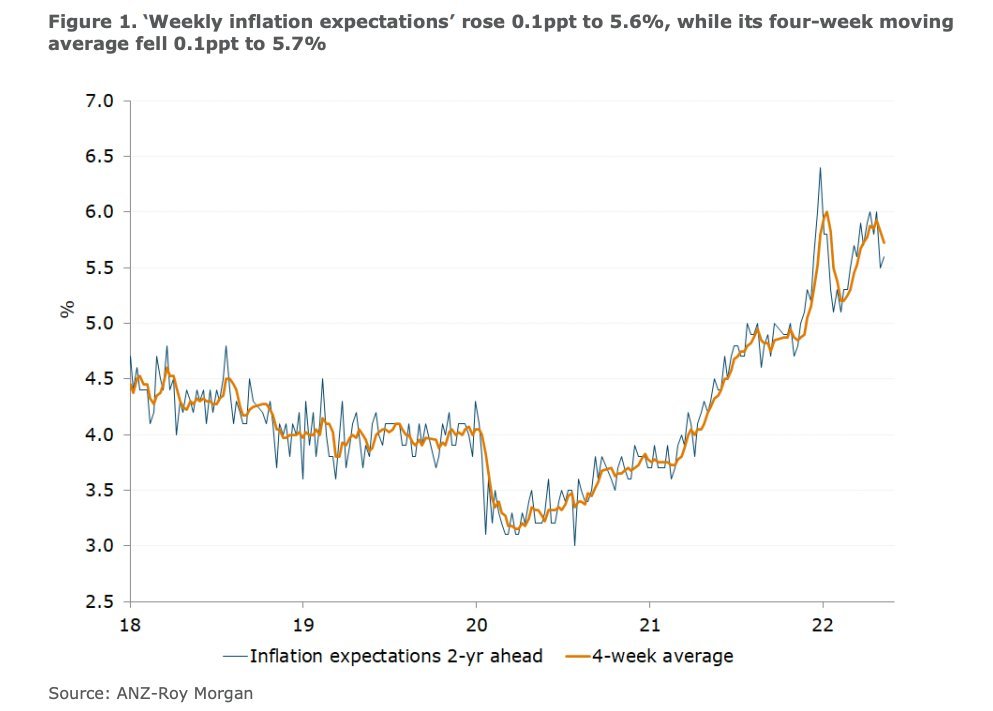

Inflation Expectations Could be Anchoring Higher

Inflation expects rebound in the last month to 5.6%. This means inflation expectations have now been anchored above 5.0% for almost a year, despite aggressive action from the RBA to tame inflation. This is going to be a significant concern for the RBA. The longer inflation expectations remain high, the more risk there is that expectations become anchored at these levels and we see lodger term inflation flow from pricing decisions and wage demands.

June 2022 Personal Insolvency Stats

AFSA has released personal insolvency stats for June 2022.

Last month there were 852 personal insolvency appointments, an increased on the 751 in May. This is slightly lower than the 888 we have in June 2021 and less than half of the long run average.

AFSA has released personal insolvency stats for June 2022.

Last month there were 852 personal insolvency appointments, an increased on the 751 in May. This is slightly lower than the 888 we have in June 2021 and less than half of the long run average.

In June there were:

⚡️ 503 Bankruptcies

⚡️ 338 Debt Agreements

⚡️ 11 Personal Insolvency Agreements

For all of FY2021-22 there were 9,550 personal insolvencies, significantly less than the 10,628 in FY2020-21 and less than half of the 21,079 we saw in FY2019-20.

Personal insolvency appointments still have a long way to go to get back to pre-pandemic levels. However, I expect to see them pick up substantially over the next 18 months as the impact of higher interest rates, slow wage growth, high inflation and a probable recession all combine to put more individuals into financial difficulty.

June Quarter Inflation

Australia’s quarterly inflation figures are out for the June quarter, and they aren’t quite as bad as expected. Don’t be fooled by this, they are still really bad.

⚠️ Headline inflation came in at 6.1% YoY, lower than the 6.3% estimate.

⚠️ Trimmed mean inflation (the RBA’s preferred measure) was ahead of estimated at 4.9%.

Australia’s quarterly inflation figures are out for the June quarter, and they aren’t quite as bad as expected. Don’t be fooled by this, they are still really bad.

⚠️ Headline inflation came in at 6.1% YoY, lower than the 6.3% estimate.

⚠️ Trimmed mean inflation (the RBA’s preferred measure) was ahead of estimated at 4.9%.

⚠️ 80% of the goods and services that comprise the CPI basket saw price rises of more than 2.5%.

⚠️ Inflation for non-discretionary items was at 7.9%, this is the stuff that hits households the hardest.

⚠️ The biggest contributors to inflation last quarter were housing construction, automotive fuel, and furniture.

⚠️ Despite the well documents rental crisis in NSW and VIC, the ABS still has rentals in both those states down YoY. This is likely due to data timing, and increased rents will hit inflation next quarter.

It’s clear that inflation is becoming more broad based and entrenched. The RBA needs to hit the issue on the head with more aggressive rate rises.

Australia has erased over a decade of wage growth in just the last 18 months.

This quarter’s inflation print pushes real wages down to the same level they were in December 2011. This will have devastating long-term effects on employees in Australia. It will take years for real wages to recover the ground they have lost and undo the damage that this short inflation spike has already wrought.

This is one of the many reasons why arguments that the RBA should go slow on rate increases and let inflation run to reduce the risk of a recession are so wrong-headed. Inflation has debilitating long-term effect on the prosperity and stability of a country.

I’d like to see something between 75 and 100 basis points next week.

The RBA Review Should Consider Nominal GDP Targeting

The government has released the terms of reference for the independent review of the RBA. They are pretty comprehensive.

The government appears very committed to inflation targeting, and this is the ‘default’ approach across most of the developed world. However, I hope the review board consider other options, like Nominal GDP Targeting (NGDPT).

The government has released the terms of reference for the independent review of the RBA. They are pretty comprehensive, covering:

- The RBA’s objectives, as outlined in the Reserve Bank Act (1959) and in the Statement on the Conduct of Monetary Policy, including the continued appropriateness of the inflation targeting framework.

- The interaction of monetary policy with fiscal and macroprudential policy, including during crises and when monetary policy space is limited.

- Its performance in meeting its objectives, including its choice of policy tools, policy implementation, policy communication, and how trade‑offs between different objectives have been managed.

- Its governance (including Board structure, experiences and expertise, composition and the appointments process) and accountability arrangements.

- Its culture, management and recruitment processes.

I’m very happy to see the review will specifically be looking into the appropriateness of the RBA’s inflation targeting framework.

The government appears very committed to inflation targeting, and this is the ‘default’ approach across most of the developed world. However, I hope the review board consider other options, like Nominal GDP Targeting (NGDPT).

NGDPT offers several advantages over inflation rate targeting that make it a superior tool for central banks:

- Targets price levels rather than the rate of change in price levels.

- Increases the relative importance of output or employment in the economy when setting monetary policy.

- It responds to shocks in both aggregate demand and aggregate supply.

- It encourages sounds fiscal policy and discourages unsound policy by offsetting changes in fiscal policy.

- It dispenses with the zero-lower-bound and makes negative rates more palatable.

NGDPT would deal with several of the terms of reference for the review. In models, NGDPT would have dealt better with the recent shocks to the economy (like the GFC and COVID) than inflation targeting did.

The Saga of Elon and Twitter

As has been widely reported, Elon has unilaterally terminated his agreement to buy Twitter. Almost since the minute Elon announced he was going to acquire Twitter, the writing has been on the wall for the deal to collapse. Elon has a long history of announcing things that never actually happen, so I had no real confidence he would actually end up buying Twitter. All the fun was in seeing how he tried to wiggle out of the deal.

As has been widely reported, Elon has unilaterally terminated his agreement to buy Twitter. Almost since the minute Elon announced he was going to acquire Twitter, the writing has been on the wall for the deal to collapse. Elon has a long history of announcing things that never actually happen, so I had no real confidence he would actually end up buying Twitter. All the fun was in seeing how he tried to wiggle out of the deal.

By way of background, Elon Musk, the richest man in the world (he’s worth about $260 Billion right now) offered $54.20 a share to buy Twitter (after a whole saga where he purchased some shares and joined the board and quit the board). Elon’s musings about buying Twitter pretty quickly moved on to signing a legally binding merger agreement. Unfortunately for Elon, shortly afterward, tech stocks imploded and both Twitter and Tesla’s stocks lost significant value.

This left Elon in a pretty bad position, he had locked himself into buying Twitter for significant more than it was now worth. It was pretty clear from his public statements that, at this point, Elon had decided he wanted out of the deal. Unfortunately for him, the agreement he signed didn’t give him a lot of wiggle room to get out of the deal.

Ultimately, his lawyers came up with three pretexts for Elon terminating the agreement and issued a letter to that end. (You can read the letter at: https://www.sec.gov/Archives/edgar/data/1418091/000110465922078413/tm2220599d1_ex99-p.htm)

None of these pretexts are strike me as particularly compelling. But let’s go through them, from worst to best:

First, Elon alleges that Twitter failed to continue to conduct its business in the ordinary course. Here, Elon makes some specific accusations:

“Twitter’s conduct in firing two key, high-ranking employees, its Revenue Product Lead and the General Manager of Consumer, as well as announcing on July 7 that it was laying off a third of its talent acquisition team, implicates the ordinary course provision. Twitter has also instituted a general hiring freeze which extends even to a reconsideration of outstanding job offers. Moreover, three executives have resigned from Twitter since the Merger Agreement was signed: the Head of Data Science, the Vice President of Twitter Service, and a Vice President of Product Management for Health, Conversation, and Growth. The Company has not received Parent’s consent for changes in the conduct of its business, including for the specific changes listed above.”

While a whole lot of legal ink has been spilled over the years on what is and is not ‘in the ordinary course of business’. In this case, Elon is drawing a very long bow. Firing a few employees in generally going to be in the ordinary course of business, and having employees quit is hardly Twitter’s fault. It also feels pretty reasonable to institute a hiring freeze given the current economic climate. A lot of other tech companies have done the same (including Elon’s own Tesla).

Second, Elon agues that Twitter is lying about the number of bots and fake accounts on the platform. Elon specifically states that he “strongly believes that bots are wildly higher than 5%”. He provides absolutely no evidence at all to support this ‘strong belief’, probably because he doesn’t have any.

Even if he can prove that bot accounts are a bit higher than Twitter has been disclosing, it won’t help Elon. To terminate the agreement, Elon would need to show that this has a ‘material adverse effect’ (MAE) on Twitter’s business. A few percent here and there in bot account numbers just isn’t going to get over that bar.

Twitter has made public disclosures for years that the numbers of bots and spam accounts on the platform is around 5% so unless Twitter has been perpetrating a massive fraud on its shareholders and advertisers for almost a decade, and Elon is the only one to have noticed, the bot excuse is just hot air.

Elon’s final pretext, while still pretty terrible, is probably the best of Elon’s arguments, but the way he has gone about making it has almost entirely undermined it. Under the agreement, Twitter has to comply with reasonable requests from Elon for information.

So, Elon and his lawyers adopted an incredibly transparent strategy of asking Twitter for ever-increasing amounts of ever more esoteric data from Twitter and when Twitter baulked a providing some of the information, or didn’t provide the information in exactly the format Elon wanted, boom, pretext for terminating the agreement.

This is unlikely to work. It’s just too obvious what they’ve tried to do here, and it’s clear from filings that Twitter has made a serious effort to provide Elon with any information he reasonably requested. The agreement requires Twitter to provide him with information that he needs “for any reasonable business purpose related to the consummation of the transactions contemplated by this Agreement”, not absolutely anything he asks for.

In fact, Elon has made it pretty clear in his public comments that he has been seeking information for the express purpose of getting out of the deal, giving Twitter a reasonable excuse to withhold information. Twitter also doesn’t have to give Elon any information that would “cause significant competitive harm to the Company or its Subsidiaries if the transactions contemplated by this Agreement are not consummated”. Given Elon’s publicly stated purpose for requesting all the information is to show that Twitter has been perpetrating a massive fraud on their investors and advertisers, they probably have a reasonable argument here for not providing the information as well.

So, where does this all go next? Twitter has started taking steps to sue Elon seeking specific performance of the Contract, and they’ve retained some high-profile lawyers to represent them. This is most likely the only good outcome for Twitter. Given the damage this whole sage has caused to their business, getting only the $1 billion damages set out in the contract would be a disaster for Twitter.

It’s going to be very interesting to watch how this plays out.